3 Most Common Home Inspector Insurance Policy Pitfalls

Last Updated November 8, 2023

Did you know that not all home inspector insurance policies are created equal? Or that policies can exclude some business practices? If you don’t know the ins and outs of your policy, you could end up buying less coverage than you need. In this article, we go over three of the most common insurance policy pitfalls plaguing the home inspection insurance industry. Look for these pitfalls when shopping or renewing insurance to ensure you’re getting the coverage your business really needs.

Did you know that not all home inspector insurance policies are created equal? Or that policies can exclude some business practices? If you don’t know the ins and outs of your policy, you could end up buying less coverage than you need. In this article, we go over three of the most common insurance policy pitfalls plaguing the home inspection insurance industry. Look for these pitfalls when shopping or renewing insurance to ensure you’re getting the coverage your business really needs.

Your insurance carrier doesn’t cover it.

Exclusions are the portions of your policy that define what you are not covered to inspect. Some exclusions are permanent while others can be modified with an endorsement. (More on endorsements in the next section.) Exclusions allow the insurance company to offer more competitive rates by eliminating business practices that go beyond the policy’s intent. Common non-endorseable exclusions in home inspection errors and omissions (E&O) and general liability (GL) policies include:

- Asbestos

- Pollution

- Improper licensure

- Warranty claims

To find out what exclusions lie in your policy, you’ve got to read it. And before you do, you should know whether your policy offers basic or broad coverage.

- Basic policies state what’s covered, and anything that isn’t listed is an uncovered inspection. These policies tend to be easier to read because they’re shorter, but they often offer less coverage.

- On the other hand, broad policies offer more open-ended coverage than basic policies. If an exclusion isn’t on the list, then it’s automatically covered. These policies are a tough read but much more comprehensive. (In case you’re wondering, InspectorPro offers broad policies.)

Keep in mind that there are insurance carriers that advertise to property inspectors but explicitly exclude home inspection services in their policies. If you receive a quote for hundreds or thousands of dollars less than that of a specialized home inspection insurance provider, be sure to study the policy to make sure home inspections aren’t excluded.

Non-inspection isn’t protection.

Remember how we said that some exclusions can be overwritten? Modifications to your policy are made possible by endorsements. Endorsements are amendments to your policy that modify coverage, usually by adding additional coverage or changing exclusions.

That laundry list of specialty inspections in all of your quotes? Those are optional endorsements, which means they aren’t included in your policy unless you add them. Examples of endorsable exclusions include:

- Mold

- Pest

- Pool and spa

- Radon

- Lead

- Carbon monoxide

- Wind mitigation

- Code

- Mortgage and field services

- Sewer scope

- Septic

- Equipment

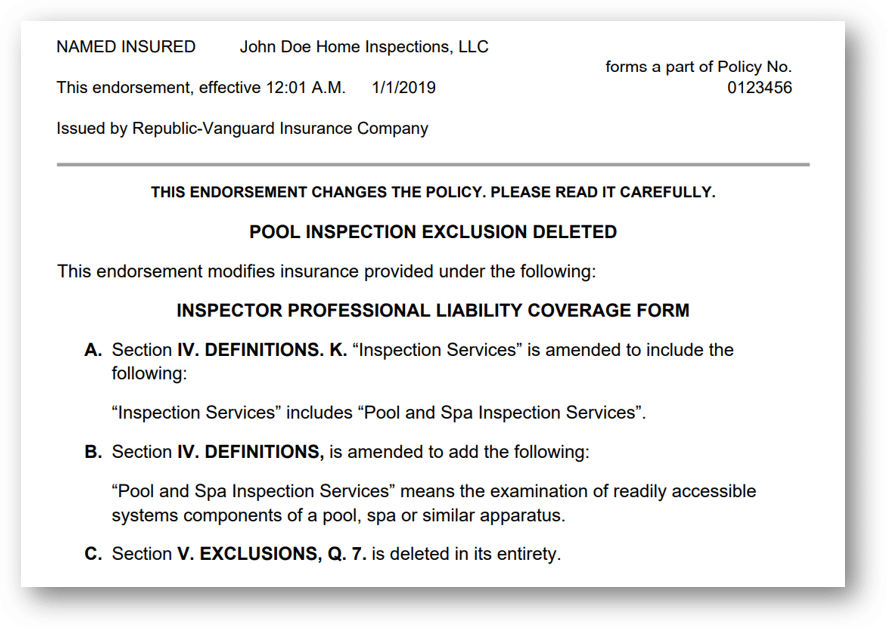

Here’s an example of what an endorsement looks like in our policy:

Notice how the endorsement modifies the policy by first deleting the exclusion. Then, it adds coverage to the policy by changing the policy definitions to include pool and spa inspection services.

Optional doesn’t mean unnecessary.

In the case of endorsements, “optional” is not a synonym for “unnecessary.” Endorsements are essential for any inspectors going the extra mile and offering a little extra with their basic inspection. Whether you’re inspecting for termites or radon, if you’re inspecting for it at all, you need to add the endorsement to receive insurance protection. If you’re not carrying the endorsement, you don’t have the related coverage—even if the claim is frivolous.

For example, most mold claims are against inspectors who do not inspect for mold. That means most mold claims lack merit. However, in order to receive coverage for meritless mold claims, home inspectors must carry the mold endorsement. (You can read more about avoiding mold-related claims here.)

Even if your specialty inspection isn’t one of the five most common types of claims, you may decide to carry the endorsement to avoid the cost of an uncovered claim. Ultimately, it’s up to you to determine what coverage you need to maintain peace of mind. (You can learn more about endorsements in our article about ancillary inspection services here.)

$1,000,000 might not be $1,000,000.

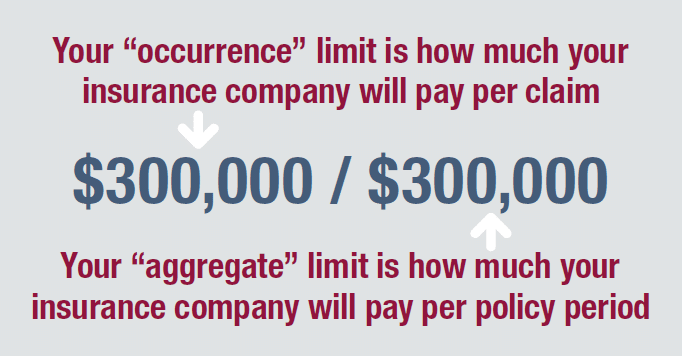

When you purchase errors and omissions (E&O) and general liability (GL) insurance, your provider will ask you to select what insurance limits you prefer. Insurance limits represent the total dollar amount your insurance company can pay toward your covered claims in a given policy period. Policies write insurance limits in the following format:

Typically, you have options, from $100,000 / $100,000 to $1,000,000 / $2,000,000. The most popular limits choice among home inspectors is $1,000,000 / $1,000,000. But, depending on your home inspection insurance policy, million-dollar limits might not really be worth $1,000,000. The reason: sublimits and shared limits.

Sublimits

Sublimits put a limit on certain risks, usually ancillary services, defined in your insurance policy. Sublimited policies give you additional services endorsements with less protection per individual service. This can be an issue for a few reasons:

- Specialty inspections often lead to claims.

- Sublimits can put you out of compliance with state insurance requirements.

To learn more, read the sublimits section of this article.

Shared Limits

Policies with shared aggregate limits will have only one limit for both E&O and GL insurance. Like sublimits, insurance carriers may turn to shared limits as a way of offering inspectors cheaper policies. The problem with shared limits? Once the shared limit is used up, you are out of coverage. (Learn more about in the Separate vs Shared Limits section here.)

What’s In Your Insurance Policy?

So what’s in your home inspector insurance policy? Depending on whether it’s basic or broad, your policy dictates coverage by what it doesn’t or what it does include (respectively).

Be sure to read up on your policy so that you don’t fall for common insurance policy pitfalls and miss out on important coverage benefits. When you renew is a great time to check for policy pitfalls and make sure you know what you’re buying.

Haven’t purchased your E&O and GL coverage yet? Apply for a quote today.

Editor’s note: InspectorPro originally published this post in July 2016. It has completely revamped and updated the post for accuracy and comprehensiveness.