How to choose the right home inspector insurance limits

Last Updated November 9, 2023

Imagine: While inspecting an upper unit of a luxury apartment complex, you left the tub running and caused water damage to that unit and the several beneath. One of the tenants below was a serious fashion designer, whose entire collection for their upcoming show was ruined. Another tenant was an elderly widow with Alzheimer’s who suffered some significant physical and emotional distress from having their apartment damaged and having to relocate until the damage was repaired. Yet another was a professional gamer with thousands of dollars in computer and recording equipment lost in the flooding.

An opportunistic lawyer read about the accident online and rallied your client and the tenants against you in one hefty lawsuit. You quickly called your home inspector insurance provider, and they hired you some great defense counsel. After months of preparation, your court date arrived. Having been responsible for the accident, things went better than your worst fears but still not great. Final costs, including payout to the plaintiffs, totaled around $600,000.

You had one last problem: Your insurance coverage limits. You only have $100,000 in coverage. That leaves you responsible for $500,000 out of your own pocket.

The example above is an extreme one. But many home inspectors like you carry insurance for worst case scenarios. What is the coverage limit in insurance? What if your insurance limits aren’t high enough to cover costs when disaster strikes? How do you know if you have enough insurance coverage before you get a claim? We discuss how to choose the right insurance coverage limits for your business.

What are insurance limits?

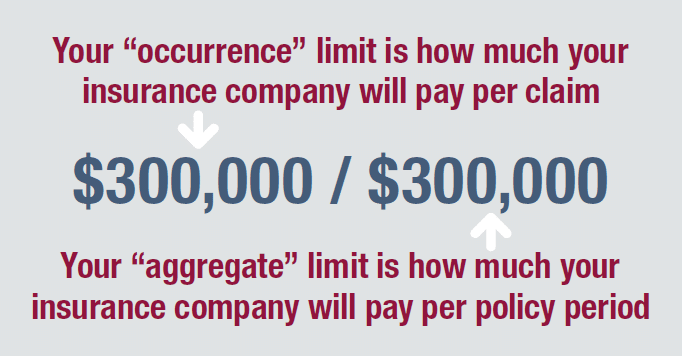

Insurance limits represent the total dollar amount your insurance company can pay toward your covered claims in a given policy period. They’re your maximum insurance coverage per claim and per period.

Policies write insurance limits in the following format:

While it’s popular for occurrence and aggregate limits to be the same, they aren’t always. For example, some companies allow you to have a lower occurrence amount and a higher aggregate amount. However, at InspectorPro, we generally caution against lower occurrence limits since they assume businesses will receive multiple smaller claims instead of one big one—which isn’t always the case.

InspectorPro with the ASHI Advantage and other insurance companies offer coverage limits such as:

- $100,000 / $100,000

- $300,000 / $300,000

- $500,000 / $500,000

- $1,000,000 / $1,000,000

- $1,000,000 / $2,000,000

Just how much can you expect to pay to increase your coverage insurance limits? Many providers charge as little as $50 to $300 annually per tier jump. Contact your broker for estimates on various insurance coverage amounts.

The most popular home inspector insurance coverage limits are $1,000,000 / $1,000,000. But, depending on your home inspection insurance policy, million-dollar limits might not really be worth $1,000,000. (More on that later.)

So long as your policy covers a claim, and that claim costs no more than the amount allocated in your limits of insurance, you’re just responsible for paying your deductible. That all changes when a claim exceeds your insurance limits—like in the example at the beginning of the article. When that happens, the responsibility to respond to and pay for the claim shifts from the insurance company to you. That’s why it’s so important to purchase the insurance limits that are most likely to cover your needs.

How do I choose my home inspector insurance limits?

How do I choose my home inspector insurance limits?

How can you make sure you have enough coverage? When choosing your insurance coverage limits, here are five things to consider.

- What are your state’s insurance requirements?

- Does your policy have any sublimits?

- Are you limits separate or shared?

- Are you at an increased likelihood of receiving more expensive claims?

- What’s your risk tolerance?

Let’s look at these five factors in more detail.

State Insurance Requirements

Some states require home inspectors to carry insurance. Most of those states require a specific dollar amount. As of January 2023, 31 states (62 percent) require errors and omissions (E&O) insurance and 38 states (76 percent) require general liability insurance. Thirteen states (26 percent) mandate both. (To learn more about how E&O and general liability insurance compare, click here.)

To see your state’s insurance requirements, check out our FAQs page.

Now here’s where things get a bit more complicated: While most state requirements apply to your insurance for your home inspection business generally, a handful of states have ancillary service-specific regulations. Offering mold testing in Florida? Then you better have $1,000,000 E&O limits. Looking for pests in Indiana? Then you need $300,000 in coverage.

But, as we said in the last two articles, be wary of simply meeting the minimum requirements. Just because your state doesn’t expect you to carry higher limits doesn’t mean you don’t need more coverage.

Sublimits

Remember when we said that $1,000,000 might not be $1,000,000 in practice? That’s because of sublimits and shared limits. Let’s talk about sublimits first.

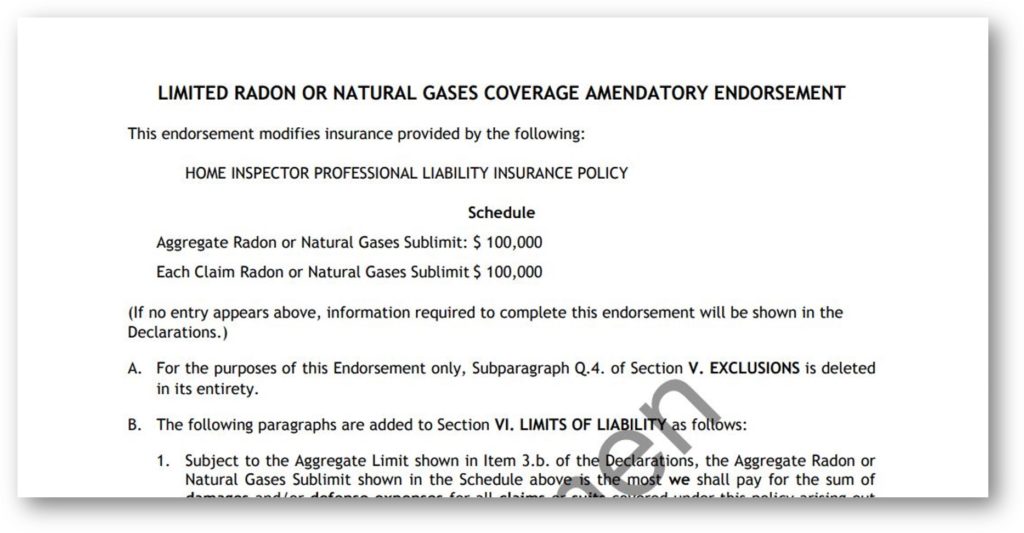

Sublimits cap certain risks, usually additional services, defined in your insurance policy. Sublimited policies offer you ancillary services endorsements with less coverage per individual service. Since InspectorPro doesn’t sublimit, here’s an example from another insurance provider’s policy:

In the example above, the insurance carrier has sublimited a home inspector who’d originally purchased $1,000,000 / $1,000,000 in coverage. Note that his million-dollar limits do not apply to his radon inspections. Instead, the inspector receives just $100,000 per claim and per policy period for radon-related issues.

Why do sublimits matter?

Sublimits can be a problem because specialty inspections are already more likely to result in a claim. Most of the time, when you’re paying for a higher limit, you’re trying to mitigate those bigger risks. But you’re not avoiding heavy-hitting claims with your $500,000 limits if your sublimits say your policy will max out at $250,000 per pool and spa claim.

Worse still, sublimits can cause you to be out of compliance with your state or contractual obligations. For example, if you’re in a state that requires, say $1,000,000 in mold coverage, you cannot meet that requirement with a $100,000 sublimit. That’s why, when choosing your coverage, you must consider sublimits.

Generally, we recommend avoiding sublimits. Often, sublimits don’t appear on your declaration’s page—that quick summary of coverage—so it’s important to read your policy in full. If you do opt for a sublimited policy, we suggest balancing it out with higher limits.

Separate vs Shared Limits

The other thing that makes $1,000,000 not really $1,000,000? Shared limits.

Separate limits give you two occurrence and aggregate limits: one for your E&O and one for your general liability coverage. Alternatively, shared limits give you one occurrence and one aggregate limit for your E&O and general liability coverage to share. Since separate limits give you two limits for the price of one, you get more coverage than you would with shared limits for the same price.

The potential problem with shared limits lumping claims together is that there’s less money to cover claims.

Let’s say your business has a $300,000 E&O claim followed by a $100,000 general liability claim in the same year. If you have $300,000 shared limits, they won’t help you with that second claim. It’s your responsibility to respond to any claim exceeding that shared aggregate limit.

As with sublimits, we discourage shared limits. However, if you must have them, you may want to double the limits you would ordinarily carry to have comparable coverage to separate limits.

Increased Likelihood

Not even the best insurance professional can predict when and why you’ll have a claim and how expensive it will be. But based on claims data and patterns, we can make some pretty good guesses.

If you follow our blog, you’ve seen our lists of common allegations, including the Top 5 Claims, the Most Common 5 General Liability Claims, and the Top 10 Reasons Clients File Claims. The first two focus on prevailing defects, like water damage and mold, and frequent accidents, like garage door breaks and power outages, that lead to claims. The last list concentrates on the circumstances that lead to claims across claim types, like complaints outside the standard of practice or defects concealed during the inspection.

In addition to these trends, here are a few other factors that may lead to claims. If you find yourself running into one or more of them, you may opt for higher limits to outweigh your potentially increased risk of claims.

- Expensive Properties, Wealthy Clients: If you tend to inspect in an affluent area and for well-off clients, you may be subject to more expensive claims.

- Commercial Jobs: Bigger projects have bigger price tags. And when your clients become businesses rather than individuals, you can expect some additional exposure.

- Experience: Contrary to popular belief, it doesn’t make risk management sense to start with lower limits while you’re inspecting less. After all, less experienced inspectors can make more mistakes. However, it is smart to increase your limits the longer you’re in the industry. The longer you inspect, the more inspections you’ll have performed, any of which can lead to a claim against you now or in the future. (Just be sure to keep your retroactive coverage intact.)

- Volume: Similar to the above, the more you inspect, the more chances you have to get a claim.

Risk Tolerance

Risk Tolerance

Clients often ask brokers which insurance limits are best. For most inspectors, there is no right answer. Inspectors ought to choose limits that match their risk appetite.

Risk tolerance varies from person to person. It’s how much you’re willing to leave to chance versus how much you want to protect yourself.

In this case, someone who chooses lower limits would have higher risk tolerance than someone who chooses higher. That’s because lower limits are more likely to be lower than the cost of a claim than higher limits.

We asked Jan Banks of Inside Out Home Inspection in Oklahoma City how she would advise a new home inspector to select their limits. When choosing limits, she recommends considering inspection region, home value, and inspection volume—not just now but in the future.

“It will be a fluid thing that will change,” Banks said. “Your limits need to meet you where you are and where you’re going.”

For Banks personally, it’s important for her insurance limits to be able to cover the most expensive claim her business could face.

“Not every house I look at is two million dollars, but I want my insurance to cover the highest level of mistake that could be made,” Banks said.

At InspectorPro, we encourage you to weigh your options and choose the insurance coverage amount that makes the most sense for you. When determining your risk tolerance, ask yourself what helps you sleep at night. Perhaps your state requires just $100,000 in limits. But if limits that low make you nervous, it’s wise to purchase a higher amount.

Insurance coverage limits for home inspectors

As your business changes, your insurance needs may expand. It’s important to know your options and when to adjust. And for those of you buying insurance for the first time, it’s just as essential to be informed so you don’t buy a policy that doesn’t meet your coverage needs. Whether it’s your first or tenth time buying coverage, make sure to choose your home inspection insurance limits wisely.

We originally published an article about choosing insurance limits in February 2018. In March 2023, we published the revised and revamped version you just read. This same updated article appeared in the March 2023 issue of the ASHI Reporter.