Insurance Deductible Explained: What Inspectors Need to Know

Last Updated November 9, 2023

Two home inspectors receive claims for unidentified water intrusion. Both are at fault. And yet, one home inspector pays $1,500 to resolve the issue while another pays $5,000. The difference between the two: their deductibles.

As the example above shows us, it isn’t just the cost at renewal (your premium) that matters. You should also consider your deductible, the price you pay if you receive a claim. When you acquire insurance, your insurer gives you several deductible options to choose from, and you pick the one that best fits you and your business’ needs. It affects your home inspector insurance coverage and your financial output.

How can you tell if you picked a good deductible? How does it work? And if you get a claim, what can you do to save money on your deductible? Continue reading to learn how your deductible determines what you spend and when.

What is a deductible?

A deductible in an insurance policy is the amount you pay your insurance company to resolve a claim. If you carry both general liability (GL) and errors and omissions (E&O) coverage, each will have their own deductibles. In the home inspection industry, most general liability policies have one deductible around $1,000. Alternatively, many E&O policies allow you to choose your deductible. Typical options include:

- $1,500

- $2,500

- $5,000

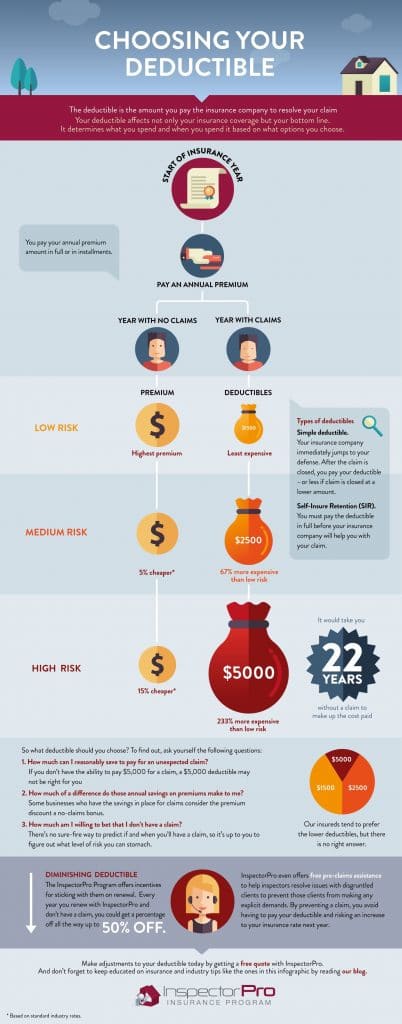

How much is an insurance deductible usually? The price per claim is whichever option you choose, like the ones above. The price per policy period, meaning how much premium you pay for your deductible regardless of claims and each policy period, depends on the amount you choose.

For example, if you choose a higher deductible, you’re taking more responsibility for claims. By carrying more of the risk yourself, you and a higher deductible results in a less expensive, annual premium. So, while you take more financial responsibility for claims, you don’t have to pay as much to renew your policy every year.

For each deductible tier, you may expect to reduce your premium price from 3 to 15 percent. For most inspectors, that’s a difference of $50 to $300 annually.

Self-Insured Retention vs Deductible

Deductibles come in two forms: simple deductibles and self-insured retentions (SIRs). Both are your responsibility to the insurance company in exchange for handling a claim. But the two work in different ways.

With a simple deductible, your claims defense starts before you pay. And if closing the claim costs less than your simple deductible, you pay that lesser amount. Here at InspectorPro, we offer simple deductibles.

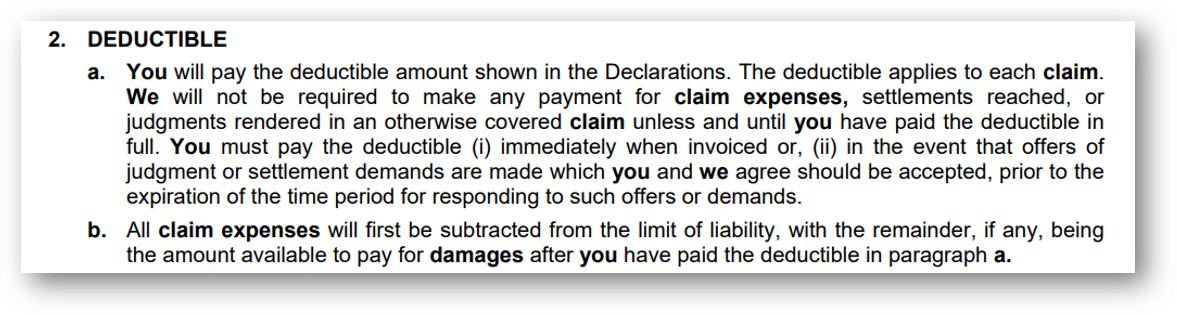

What does self-insured retention mean? It means your insurer requires you to pay your deductible up front to initiate your coverage. In other words, you have to pay your SIR in full before the insurance company will start defending you. And if your claim closes at a lower rate than your SIR, you can’t guarantee getting the difference back. Here’s an example of an SIR from another provider’s home inspection insurance policy:

In the example above, notice how the insurance company doesn’t come out and say they have an SIR. However, you can tell their deductible is an SIR from the description:

“We will not be required to make any payment for claim expenses…unless and until you have paid the deductible in full.”

Sometimes, self-insured retentions cost less annually. But not always. And because they require payment up front for insurance coverage in a claim, they may not be a good option for inspectors who lack thousands of dollars in emergency savings to spend on a moment’s notice.

To determine if you have a simple deductible vs self-insured retention, read your home inspector insurance policy. The difference may impact how much money you want to save now to pay your part of a future claim.

What is a good insurance deductible?

What is a good insurance deductible?

As with most things in life, what’s “good” is a matter of opinion. At InspectorPro, our insureds tend to prefer lower deductibles. Nearly 80 percent of our inspectors opt for the $1,500 or $2,500 deductibles, leaving just over 20 percent selecting our highest option of $5,000.

Below, we explore home inspectors’ arguments for both lower and higher deductibles.

Save Money Later: A Case for Lower Deductibles

Do you prefer to pay more now with the chance of saving money later? Then choose a lower deductible, like Mark Silliman of A Closer Look Home Inspection Service, LLC in Washington did. As Silliman prepared for retirement and put time into his other business, he found security in a lower deductible he could more easily keep in reserve in case a claim arose.

Bud Wenk of Z Best Inspection Services in Kentucky shared the same sentiment. For Wenk, a lower deductible is worth the higher annual cost.

“From what I saw on the savings on the premium, it doesn’t make much of a difference,” Wenk said. “Because if I got to make a claim, I’m actually going to save money.”

Just how much could you save with a lower deductible?

Let’s say we have two inspectors: Inspector Jenny and Inspector James. Jenny chooses the $1,500 deductible while James chooses the $5,000 deductible. Both receive a $10,000 claim and are found liable. Jenny pays her $1,500, and James pays his $5,000 to the insurance company. James paid 233 percent more than Jenny for a claim with the same dollar amount. In fact, it would take James 22 years without a claim to make up for the cost he paid.

Save Money Now: A Case for Higher Deductibles

Some argue that it isn’t worth paying extra cash for coverage you don’t intend to use. That’s why inspectors with a higher risk tolerance often opt for higher deductibles and, therefore, lower premiums. (Remember from our last article that your risk tolerance is how much you’re willing to leave up to chance versus how much you want to prepare for potential bad outcomes.)

Brad McLeese of HomeGuard Inspections in Utah has this risk tolerance and sees a high deductible as an opportunity to save.

“I have a high deductible, and I chose that because of the cost savings for the annual premium,” McLeese said. “I’m looking at the insurance for the larger claims and not as much for the smaller claims.”

Gwen Shirvanian of HomeSpec Inspection Services, LLC in Arizona also considered her insurance as protection against large claims and was, therefore, not as concerned with the larger per-claim costs associated with higher deductibles.

“I’m not buying insurance to cover the little stuff. I’m buying it to cover the big stuff,” Shirvanian said. “I want to keep our annual rate down, and $5,000 is something we can afford.”

How else can I save with my deductible?

While “save money now or later with high or low deductibles” is still up for debate, other deductible savings are universal. Many insurance providers have deductible discounts and incentives to reward inspectors for certain risk management or claims-free behavior.

Here are a few of the deductible savings available with InspectorPro:

-

- Diminishing Deductible: A diminishing deductible endorsement–also known as a reducing, depreciating, or disappearing deductible–gives you a percentage off your deductible for consecutive years with your current insurer and without claims. Learn more here.

- Waiver of Deductible Endorsement: With a waiver of deductible endorsement–sometimes called an early reporting discount–you receive a percentage off your deductible for using pre-claims assistance. Get more information on how it works here.

At InspectorPro, you can combine the two discounts above for up to 75 percent off your deductible. Add in our model agreement discount, and you can owe as little as $0 of your deductible. That’s a huge emotional and financial relief.

The Right Home Inspector Insurance Deductible for You

With your home inspector insurance deductible explained, you are better equipped to pick the best deductible for your business.

So what deductible should you choose? To find out, ask yourself the following questions:

- How much can I reasonably save to pay for an unexpected claim?

If you don’t have the ability to pay $5,000 for a claim, a $5,000 deductible may not be right for you. If you opt for an SIR vs a simple deductible, you’ll also have a lot less notice to come up with the cash.

- How much of a difference do those annual savings on premiums make to me?

Some businesses who have the savings in place for claims consider the premium discount a no-claims bonus.

- How much am I willing to bet that I don’t have a claim?

There’s no sure-fire way to predict if and when you’ll have a claim, so it’s up to you to figure out what level of risk you can stomach.

When in doubt over whether to choose high or low, you can always choose the middle ground as most policies offer three or more options.

Want to make a change to your deductible? Contact your insurance broker to change your deductible on renewal or even mid-policy.