How to make half of your insurance deductible disappear

Last Updated November 8, 2023

From our decade of claims data, we know that the majority of home inspectors receive at least one claim in their career. And, when they do, it never feels great—particularly when that claim is meritless as about 80 percent of home inspection claims are.

In his recent article, home inspector Randy Sipe described the feeling of a first claim as “the most emotional roller coaster ride of your professional life,” primarily due to the financial worries associated with claims. As Sipe pointed out, the first step toward peace of mind is carrying errors and omissions (E&O) and general liability (GL) insurance. But your protection doesn’t have to stop there. Some insurance providers provide deductible discounts to home inspectors based on how infrequently they receive claims and on how quickly they report allegations. In Part 1 of our series, we go over how you can make half of your insurance deductible disappear.

A diminishing deductible endorsement—also referred to as a reducing, depreciating, or disappearing deductible—rewards you for your consecutive years with your current insurance provider and without claims. Below, we address some key characteristics:

Some diminishing deductible endorsements only affect your E&O coverage.

In home inspection insurance, most policies come with separate E&O and general liability deductibles. Often, home inspectors have the opportunity to choose the E&O deductible that’s right for them. (InspectorPro offers E&O deductibles of $1,500, $2,500, and $5,000.) On the other hand, insurance carriers typically determine the general liability deductible amount. (Typically, InspectorPro’s GL deductibles are $1,000.)

Since many carriers standardize most GL deductibles for home inspectors based on their own risk calculations, some diminishing deductibles only affect your E&O coverage, including ours. In order to confirm which deductible(s) your endorsement affects, read the endorsement form in your insurance policy.

Most diminishing deductible endorsements have a standard and a maximum reduction.

Is it possible to reduce your deductible to $0? Or to reduce your deductible by a larger percentage one year than the next? Not with a diminishing deductible endorsement. Most (if not, all) diminishing deductible endorsements have a standard and a maximum reduction amount.

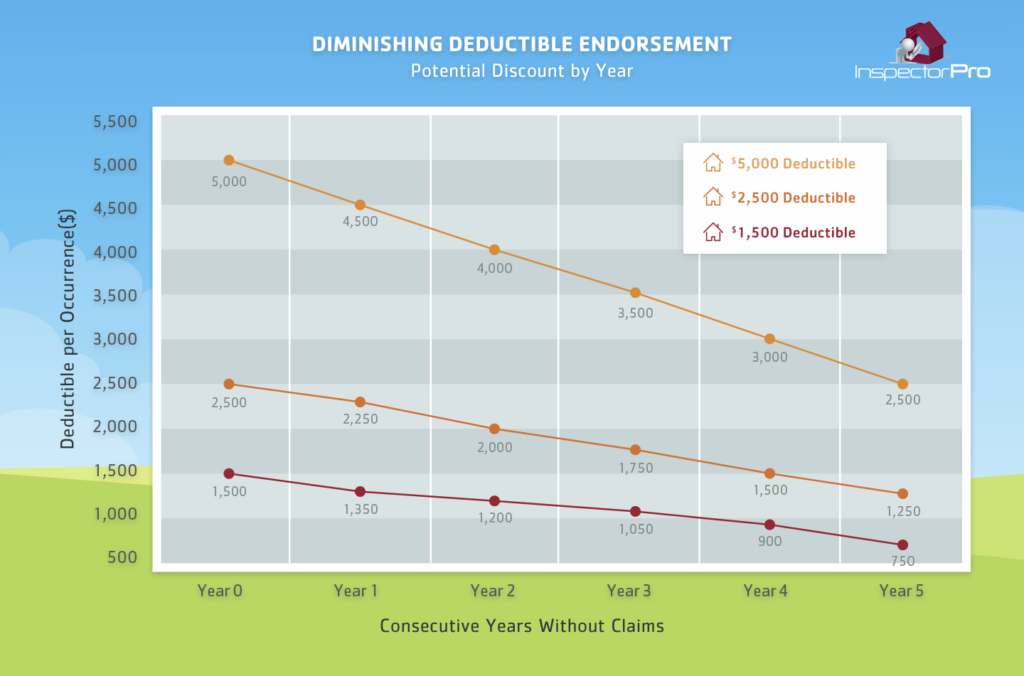

With InspectorPro, for each consecutive policy period that you do not have a claim, your E&O deductible will be reduced by 10 percent subject to a maximum reduction of 50 percent. So, each of your first five consecutive years are subject to a 10 percent reduction. And, even if you go 10 years consecutive years without a claim, the most your deductible will reduce is 50 percent.

The following graph illustrates your potential diminishing deductibles based on number of consecutive years without claims and E&O deductible:

Keep in mind that different insurance companies can offer different decreases. So, be sure to review your insurance policy or consult your insurance broker to determine a) if your current coverage offers a diminishing deductible and b) how much the deductible can reduce each year.

With most carriers, your years without claims must be consecutive.

You’ll notice we’ve repeated the word “consecutive” quite a bit thus far. When determining your diminishing deductible potential, be sure to calculate your reward based on back-to-back years without claims—not total years without claims.

Suppose you’ve been in business for six years. You had a claim in your third year and haven’t had a claim since. During your fourth insurance year, your diminishing deductible would have reset, meaning you started year four with zero consecutive years claims-free. Furthermore, in year six, you would be eligible for a diminished deductible of 20 percent.

Note that consecutive years without claims are determined by policy period—not calendar year. Your policy period is the dates during which your insurance coverage is active, from effective date to expiration date (usually a period of 12 months).

The main takeaway: If you report a claim, your diminishing deductible will reset. Your deductible will not be reduced on any subsequent claims during the remainder of your current policy period (the one during which you reported your claim) nor during the next policy period.

Who’s at fault doesn’t affect your diminishing deductible, but how much you pay may.

Even if you were at fault for your last claim, your reduction restarts at your first renewal without a claim. However, the final amount that you and the insurance company pay may factor into whether or not you have a reset.

For example, in most InspectorPro policies, it reads: “For the purposes of this [diminishing deductible] endorsement, a qualifying claim for damages and defense expenses must exceed the deductible.”

In order for your diminishing deductible to reset, the claim you receive has to cost you your full deductible. So, if you have a deductible of $1,500 and receive a claim for $500, your reducing deductible will stay intact. Conversely, if you have a deductible of $1,500 and receive a claim for $3,000, your disappearing deductible will reset.

If you switch deductibles at renewal, your percentage reduction stays intact.

With a diminishing deductible endorsement, you don’t have to worry about sticking to one deductible for every claims-free period. If you start with $1,500 one year and then decide that $2,500 is a better fit the next, you can switch deductible amounts without fearing a reset. However, note that, while the percentage off that you earned won’t change, the dollar amount will change.

For example, if you went from a $1,500 deductible to a $2,500 deductible in year two, you would still receive 20 percent off your deductible. In other words, you would receive 20 percent off the new deductible amount of $2,500 ($2,000) rather than 20 percent off the old deductible amount of $1,500 ($1,200).

But, if you remove an endorsement, your diminishing deductible will not apply to that endorsed service.

Suppose that, when you started your business, you offered pest inspections. So, when you initially purchased your insurance, and when you renewed annually, you added the pest endorsement to your coverage. After a few years in your area, you realized there wasn’t much of a demand for pest inspections. You decided to stop offering pest inspections and, during your next renewal, you stopped carrying your pest endorsement.

We do not condone the practice of removing endorsements for previously offered additional services. Why? Your insurance policy does not simply cover your home inspections performed during your policy period; it can cover past inspections, too.

Retroactive coverage, also known as retro or prior acts coverage, allows the insurance company to cover inspections that occurred before your policy began. Your prior acts coverage starts on your retroactive date, or the day you started carrying continuous home inspection insurance coverage with us or another provider. That retro coverage stays in tact so long as you renew your insurance on time each year and, if switching providers, you provide proof of retro coverage with your policy declarations.

Let’s return to the earlier example of pest inspections. Even though you may not be offering pest inspections now, you did offer pest inspections previously. Therefore, you may still receive a claim for the pest inspections you performed in the past.

In order to qualify for coverage for a pest claim that occurred prior to your current policy period:

- You need to have had insurance coverage with a pest endorsement at the time you performed the pest inspection, and

- You need to have insurance coverage with a pest endorsement at the time you receive the claim.

But what does all of this have to do with diminishing deductible endorsements?

Even if you no longer perform additional services, it’s important to continue to continue to carry endorsements. That way, you can receive coverage for retroactive specialty inspections.

If your endorsement expires, terminates, non-renews, or cancels for any reason, your diminishing deductible won’t apply to that service. Why? Because you no longer have coverage for that endorsed service. So, if you want coverage for pest, mold, code, etc.—and you want your reducing deductible endorsement to apply to those specialty services—you need to continue to carry those endorsements.

Most insurance carriers do not honor diminishing deductibles across providers.

If you decide to switch providers, you forfeit your current deductible reductions.

Said another way: Say you’re with an insurance provider who offers a diminishing deductible endorsement. You’ve been with them for two years, so your original deductible of $5,000 has decreased to $4,000. But, for one reason or another, you decide to switch insurance providers. You purchase a new policy from a new provider at renewal for the same deductible of $5,000. Even if that new provider has a diminishing deductible program, your reduced deductible doesn’t transfer over. With your new provider, you’ll reset and start accruing consecutive years without claims over again.

Save money on your insurance deductible.

Insurance claims are tough, but they don’t have to emotionally or financially damage you and your business. By purchasing E&O and GL coverage that fits your unique business needs, and by taking advantage of your diminishing deductible, you can have better peace of mind when frivolous (or legitimate) allegations strike. Why not be rewarded for being a safe home inspector?

If you’re insured with us, know that we have your back. If you receive a complaint from a client, be sure to report it to receive pre-claims assistance or claims handling. And when you do, we’ll discuss how our diminishing deductible endorsement can benefit you.

Not insured with us yet? Apply now to receive a no-obligation quote and start receiving benefits like a diminishing deductible, pre-claims assistance, and deductible waivers.

Stay tuned for more ways to save in Part 2 of our series. We’ll explore how early reporting incentives can give you deductible discounts, too.