How insurance endorsements protect your inspection business from specialty inspections

Last Updated November 9, 2023

Let me introduce you to two home inspectors. Both faced mold claims, and both lacked adequate insurance coverage to protect them from the claim but for different reasons.

Meet Dirk. Dirk’s client called after their 11-year-old son began experiencing respiratory problems for months after moving into the house. After the inspection, they’d discovered mold, and they had a doctor ready to testify in court that the mold was causing the boy’s medical problems. Dirk called his insurance company to file a claim, only to discover he had no coverage for mold claims.

Meet Stacey. Stacey’s client sent an attorney letter after they found mold in the basement. She filed the claim with her insurance company, only to receive a call from her adjuster in the middle of her defense saying there was not enough money within the limit of her insurance policy to cover the mold claim. Since she exceeded her limit of insurance for mold, Stacey was now responsible for the claim.

Both of these home inspectors had insurance coverage. So what went wrong? What could these inspectors have done differently to have protection when they needed it most? The answer in both instances is insurance endorsements.

What is an insurance endorsement?

What is an endorsement in insurance? An endorsement is a policy form that either changes or adds coverage to your insurance. You may remember last month’s article about additional insureds, in which we discussed how an endorsement can change your policy’s definition of an insured to include clients, like builders, or partners, like franchises. In this article, we’ll focus on the kinds of endorsements that add coverage for ancillary services.

Many home inspector insurance policies exclude coverage for ancillary services—or additional services that go beyond what’s offered in a typical home inspection. Such services, like mold sampling or radon testing, offer a more thorough assessment of the property and require a higher level of education and expertise. These add-ons also tend to be outside state and association standards of practice (SOPs). (If you do go outside your SOP, make sure your pre-inspection agreement reflects that deviation!) By purchasing ancillary services endorsements for home inspectors, you can receive protection for claims associated with those offerings.

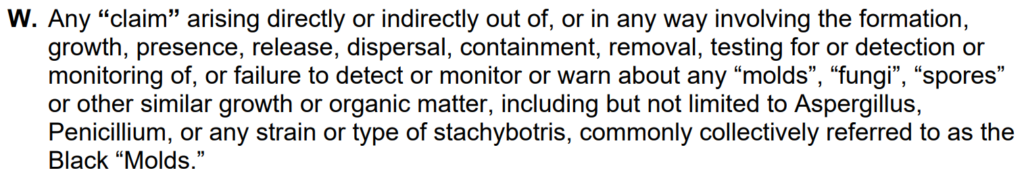

Let’s look at what an endorsement looks like on paper. In the case of mold, you can see where this policy excludes, or doesn’t include mold coverage, below. In the Exclusions section of the policy, it reads: “This policy shall not apply to:”

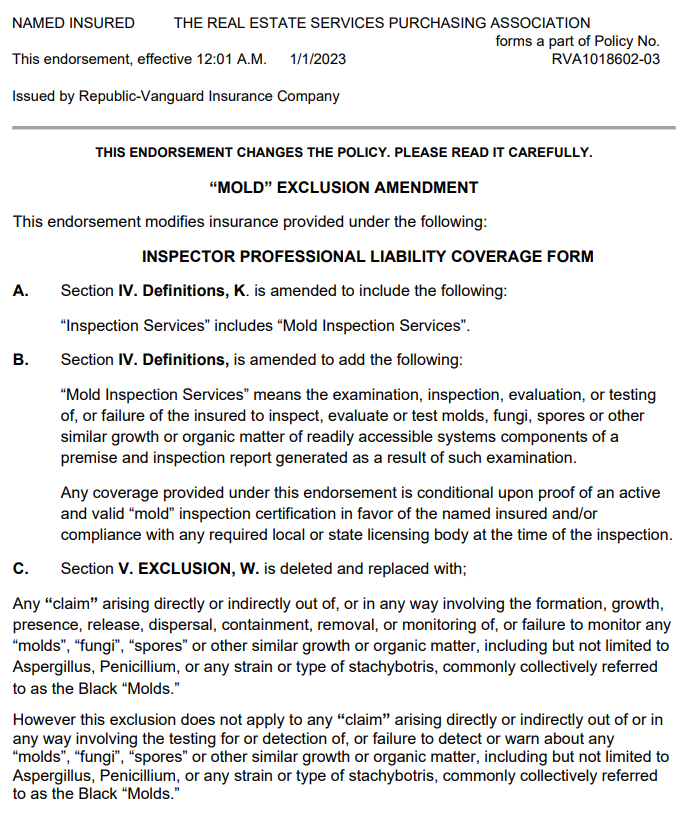

Now, here’s a look at the endorsement that overrides that original definition:

What are common endorsements in home inspection insurance?

What kind of coverage can you add to your errors and omissions (E&O) insurance policy? Examples of endorsements in insurance include:

- Mold sampling coverage for mold examination and testing.

- Sewer pipe inspection coverage for deploying cameras into sewer lines to inspect for blockages and determine pipe conditions.

- Code inspection coverage to visually determine code compliance.

- Septic inspection coverage for the visual examination of waste disposal and water purification systems.

- Carbon monoxide testing coverage to identify high levels of carbon monoxide.

- Lead testing coverage for visual examinations for lead and lead paint.

- Radon testing coverage for radon detection.

- Termite or pest inspection coverage for visual examinations to discover evidence of pests present.

- Mortgage field services coverage to verify property condition and occupancy.

- Pool and spa inspection coverage for pool and spa examinations.

- Intrusive Exterior Insulation Finishing System (EIFS) or water managed exterior insulation and finishing systems inspections to determine the presence and/or level of moisture intrusion.

Each of the examples in the list of insurance endorsements above typically include coverage for failure to inspect or identify associated deficiencies. For example, a carbon monoxide endorsement generally covers accusations saying you didn’t discover carbon monoxide when you should have.

Carriers describe each endorsement in their insurance policy definitions a bit differently, so be sure to review yours.

How much do insurance endorsements cost?

Since endorsements vary, prices vary. A typical home inspection insurance endorsement costs anywhere from one to 15 percent of additional premium annually. The exact price depends on the type of risk it covers. If you’re wondering what an insurance endorsement premium is for a specific ancillary service, simply put in an endorsement request to get a quote.

If you’re looking to expand your coverage by purchasing multiple endorsements, see if your insurance provider offers a package for a discount. With the InspectorPro Bundle, inspectors can purchase mold, radon, pest, septic, pool, code, lead, and carbon monoxide coverage together for a lower price.

What happened to Dirk and Stacey?

Let’s apply what you just learned to Dirk and Stacey’s situations. How could a mold insurance endorsement have helped each of them?

Let’s start with Dirk. Dirk didn’t endorse his insurance policy for mold, so he didn’t have coverage for mold because mold was excluded in his policy. Many home inspectors don’t purchase endorsements because they don’t perform an ancillary service often or at all. But non-inspection isn’t protection. You can still receive mold-related claims if you don’t perform mold testing. In fact, according to our data, inspectors are more likely to receive mold claims when they don’t sample for mold! Even if the claim is frivolous because you excluded that specialty inspection, you’ll still want defense and payout help from your insurer to face the allegation. So if you want your policy to respond to mold claims, or other claims for additional services, be sure to purchase the coverage.

What about Stacey? Stacey did have an endorsement, but it had a sublimit that capped her insurance policy’s coverage for mold to an amount lower than her overall policy limits. In this case, Stacey’s mold sublimit was a big problem because it led to her policy not protecting her from a particularly nasty claim. When the money set aside for mold claims ran out, Stacey had no more coverage for the claim–even though the claim was well under her overall policy limit. So, if you want your policy to fight ancillary service claims with the same force it does other claims, try to avoid sublimits.

When do I need to endorse my insurance policy?

Previous examples aside, it’s important to understand when you need to endorse your own insurance policy. The short answer: whenever you want the coverage. The long answer: It depends on the services you offer and your risk tolerance.

If you are providing an additional service, you should absolutely carry the related insurance endorsement. Mold assessors should carry mold endorsements. Radon inspectors should carry radon endorsements. Pest inspectors should carry pest endorsements. And so on. Not only does endorsing for the services you render make sense for your own peace of mind and protection, but it is also a requirement by law in some areas.

And the services you don’t perform?

What about endorsing for services you don’t offer? As the fourth most common claim against home inspectors, mold is an exception to the rule. While mold claims are more likely to be against people not testing for mold, most other ancillary service-related claims hit people that do offer those services. This isn’t to say that you still can’t get claims for any and all additional services, but your risk is generally lower.

When deciding whether to endorse your insurance policy for a particular ancillary service, consider taking a basic risk tolerance assessment. While generally used for figuring out how to invest money, these assessments can also help you figure out if you prefer lower risk, which means you should purchase more insurance, or higher risk, meaning you’re willing to buy less insurance at the risk of potentially having to face a claim alone.

An example of a question you may consider: How much am I willing to pay for claims against my home inspection business? If you’re conservative, then you’d say you want all of the claim covered by insurance. When you’re moderate, you’d say you’d be okay with a small loss. If you’re aggressive or high risk, you’d say you don’t mind losing money to a large claim.

Such a risk assessment can help determine not just what endorsements to buy but your overall insurance limits and deductibles as well. For more help finding the right coverage fit for your risk mindset, talk to your insurance broker.

Don’t be a Dirk or a Stacey.

There are lots of endorsements for home inspectors interested in safeguarding their businesses against potential claims, but purchasing coverage after a claim has already happened defeats their purpose. Having the right protection in place before claims strike is what gives you the support and peace of mind that insurance is meant to provide. If you haven’t already, take some time to review the endorsements you have and the ones you don’t and see if there’s a gap you need to fill. And don’t forget to reassess as your business and your needs change.

This article appeared in the July 2023 issue of the ASHI Reporter.