Certificate Holder vs Additional Insured: Differences Inspectors Need to Know

Last Updated November 9, 2023

Imagine: Your daughter is getting married. You plan an intimate luncheon for close relatives and friends to celebrate. Your daughter is excited–a bit too excited. As she tells people she’s getting married, she invites them to the party. When the wedding and luncheon day arrives, your small gathering of 30 has turned into a party of 150. You’re out of shrimp cocktail 10 minutes in.

Your insurance coverage can be like those glasses of shrimp: Invite too many people to partake and you can run out of protection for yourself. That’s why it’s so important to understand the difference between certificate holders and additional insureds.

What is the difference between a certificate holder and an additional insured? The short answer: The additional insured has access to your insurance coverage, while the certificate holder only knows about your coverage.

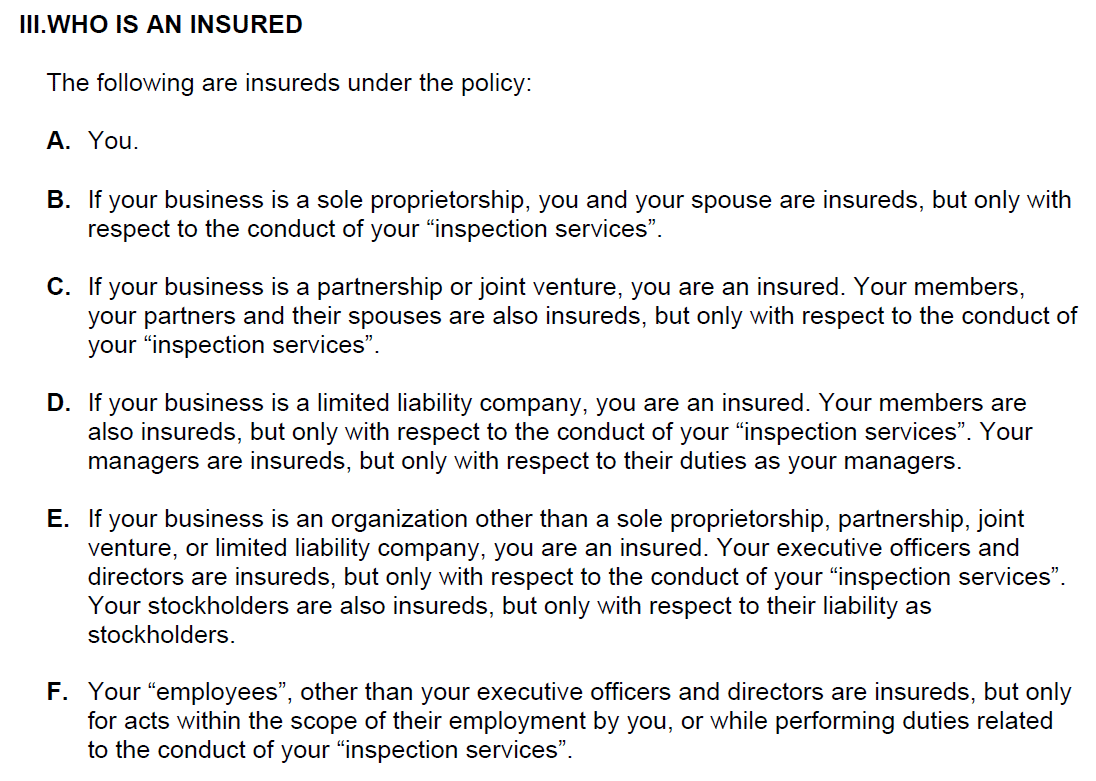

Here’s the long answer: Your insurance policy defines the term “insured” to dictate who does and doesn’t receive coverage. Most InspectorPro policies have the following definition:

Notice how the insured definition above can cover you, your business, and anyone else working for or representing your business. Adding an additional insured changes that.

What is an additional insured?

Just like the term “insured” has a specific meaning in insurance, there’s an additional insured definition, too. So what is an additional insured on an insurance policy? Typically, an additional insured is any individual or organization not automatically included under your policy’s definition that you add as an insured by request.

Who should be listed as an additional insured? In the home inspection industry, it’s common for inspection franchises to ask their franchise owners to add them as an additional insured. Why request additional insured status? Should the home inspector receive a claim, the inspection client may come after the corporate franchise, too. By becoming an additional insured on your policy, the franchise can receive protection from your policy.

Home builders are another less common situation. If you perform regular inspections for a builder, that builder may request that you add them as an additional insured to your policy, too. Then, should one of their home buyers file a claim against them relating to your inspection of their home, the builder can receive indemnity and defense through your policy.

A Word of Caution

While you can add additional insureds to your policy, we don’t recommend it unless absolutely necessary. Adding additional insured coverage to your policy gives them access to your coverage, leaving less protection for you.

For example, let’s say you receive a claim for causing severe water damage during your inspection. Your client files suit against both you and the home builder, who you’ve named as an additional insured on your policy. Since you’re both insureds, your insurance policy has to respond equally to both you and the builder. During discovery, the claims team determines that the builder is at fault, so you aren’t liable. The builder, however, still is, and they continue to use your coverage for your indemnity and defense. The builder goes to court, and the jury demands a payout to the claimant. That payment comes from your insurance, and it depletes your aggregate limit.

Later that same policy period, you receive another claim. But the builder used up your entire limit of liability, leaving no insurance coverage available for you. You have to face the claim on your own.

What about when I refer business out?

There’s another instance in which additional insured endorsements are important: when you’re the referring party. We recommend that you ask to be named as an additional insured on the insurance policies of those to whom you refer business through an additional insured endorsement and obtain proof of that endorsement with an additional insured certificate (sometimes referred to as a certificate of liability insurance additional insured endorsement).

Here’s an example: Let’s say your inspection client wants a sewer scope inspection. But you don’t offer them. So you refer them to another inspector you know that offers sewer scope inspection services. That inspector makes a mistake, and your client sues both of you: the sewer scope inspector for the error and you for the bad referral.

If you were named an additional insured on the sewer scope inspector’s policy, their policy would respond to this claim on your behalf. But if you weren’t, you’d have to use your own insurance. You may exhaust your own insurance limits defending yourself against a claim for which another inspector was at fault.

To learn more about how to protect your business when you refer clients to outside inspectors or contractors with an additional insured endorsement, click here.

What’s a certificate holder?

So is a certificate holder and an additional insured the same? No. While your additional insureds may receive copies of your certificate of insurance for their records, they are not the same.

What does it mean to be listed as a certificate holder? An additional insured has access to your insurance coverage. On the other hand, a certificate holder only knows about your coverage. By providing certificate holders with a certificate of insurance (COI), also known as proof of insurance (POI), you supply evidence of your insurance protection.

While not all COIs are identical, they typically include:

- Who has insurance coverage (you, your business, and your employees).

- Your business address.

- A coverage breakdown, including the type of insurance you have and their limits.

- The name of the certificate holder.

Generally, we recommend keeping your insurance information private. Advertising your insurance information on marketing materials or offering it to potential clients or realtors is like inviting claims. Don’t do it. However, as with most rules, there are a few exceptions.

It is appropriate to provide certificates of insurance to franchises of which you are a franchisee; builders, banks, and homeowners’ associations for whom you’re performing work; and state licensing boards that regulate inspectors. Learn more about COIs here.

Keep your guest list short.

We hope you better understand the difference between certificate holders vs additional insureds. When it comes to insurance coverage, it’s best to keep your “named insured” definition concise. Before adding an additional insured to a certificate of insurance, think twice. Don’t grant additional insured professional liability coverage to anyone, and don’t hand out certificates of insurance like candy, either. By preserving your insurance coverage for you, your business, and your employees, you increase the likelihood of your coverage being there when you need it. And isn’t that why you bought it in the first place?