InspectorPro Home Inspector Insurance: Top 5 Reasons to Choose Us

Last Updated November 8, 2023

Why purchase InspectorPro home inspection insurance? Because we give home inspectors more than other insurance providers. Here are our top five benefits:

1. First-Rate Risk Management

1. First-Rate Risk Management

Stop worrying about how you might get a claim and start doing things to prevent them. Our risk management team publishes new material twice a month so that you stay informed about your industry and get impactful insights into your home inspection insurance policy. We interview professional claims handlers, Ivy League professors, inspection school owners, and fellow home inspectors to give you exclusive information. Click here to subscribe to our newsletter to send cutting-edge content straight to your inbox.

2. Premier Pre-Claims Assistance

Potential claims keeping you awake at night? Why worry when your policy comes with pre-claims assistance? With pre-claims assistance, you get free help responding to unhappy clients so they’re less likely to make a claim against your business. Our risk management team prevents 85% of complaints from turning into claims. And even if you’re in that 15% that has a claim after all, you benefit from immediate defense council that increases the likelihood of a quicker and cheaper resolution. Plus, we’ll give you 50% off your deductible for using our pre-claims service first. That’s what we call a win-win. (Learn more about pre-claims assistance here.)

3. Diminishing Deductible

3. Diminishing Deductible

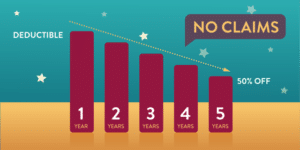

Don’t get tricked into paying more for claims when you don’t have to. With InspectorPro’s simple deductible, you don’t pay until your claim closes. That means you get all the defense before you pay out. And if closing the claim costs less than your simple deductible, you pay that lesser amount. As if not having claims isn’t enough, we reward our insureds for each consecutive year of no claims with us by “diminishing” or decreasing their deductible up to 50%.

4. Quality Customer Service

Just because you’re a niche industry doesn’t mean you have to rely on a one-man show. We’re a team of 15 licensed insurance brokers—five times the staff size of competing brokerages—and we work exclusively with home inspectors so we can give you the time and specialization you deserve. We work with multiple carriers so that we can match your business with the right coverage. And we perform the majority of our underwriting in-house, which allows us to send quotes, adjust coverage, and create certificates in 24 business hours or less. Best of all, our staffing size makes it possible for someone to be there to answer your calls and emails quickly and efficiently. Don’t believe it? Read our Google Reviews here.

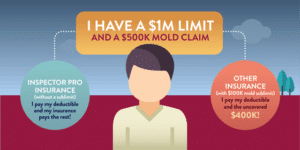

5. No E&O Sublimits

5. No E&O Sublimits