The Road to Understanding Retroactive Coverage Part 2: Claims-Made Coverage

Last Updated November 9, 2023

Now that you’re familiar with continuous coverage, we can use that knowledge to understand the second qualifier for retroactive coverage: claims-made inspection insurance.

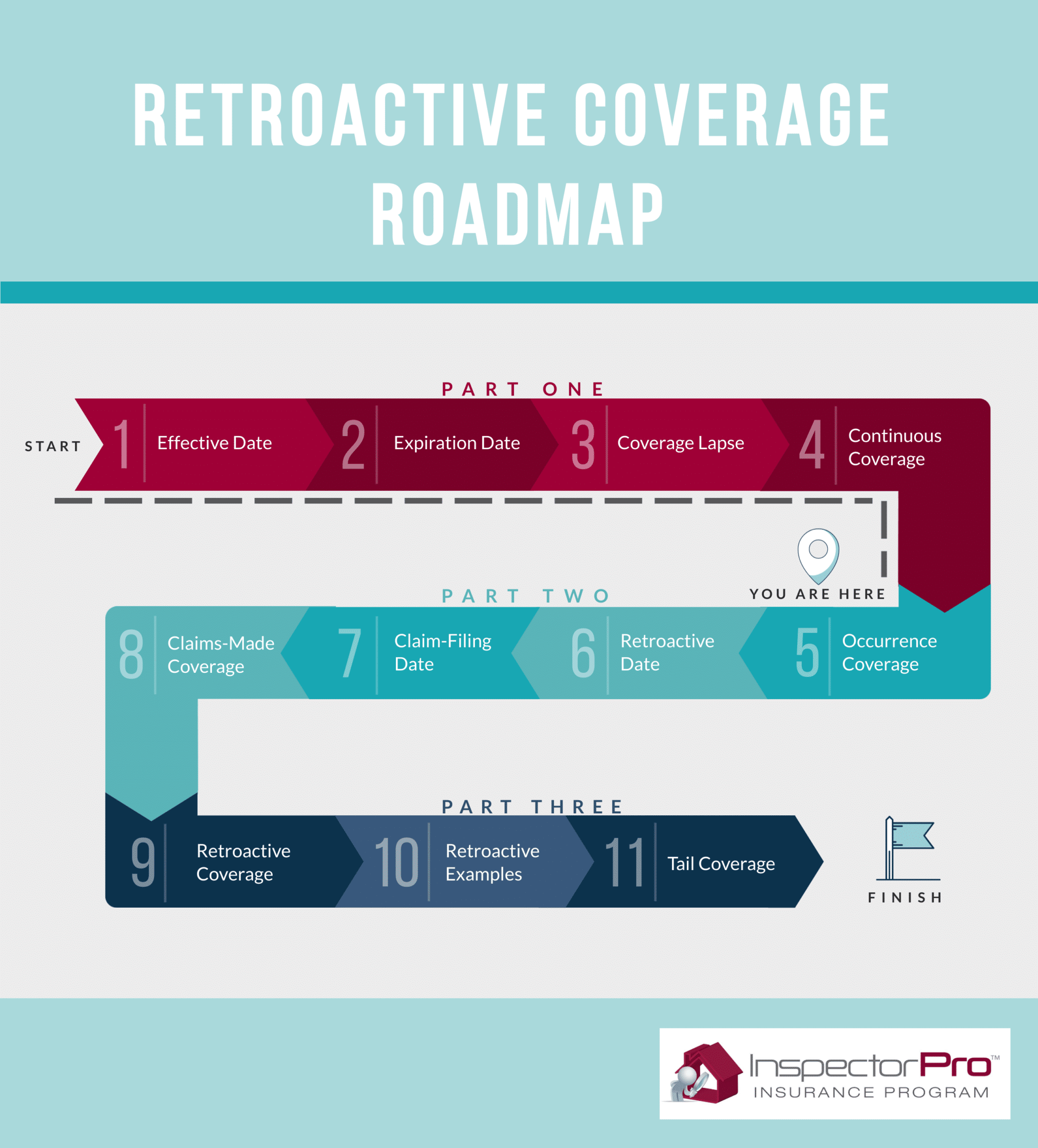

First, here is a visual of where we are at on our road to understanding retroactive coverage:

In part two of this series, we walk you through the distinctive traits for claims-made coverage to better understand the importance of retroactive coverage.

Occurrence Coverage

To define a claims-made policy, let’s first tell you what it’s not. Claims-made isn’t occurrence coverage.

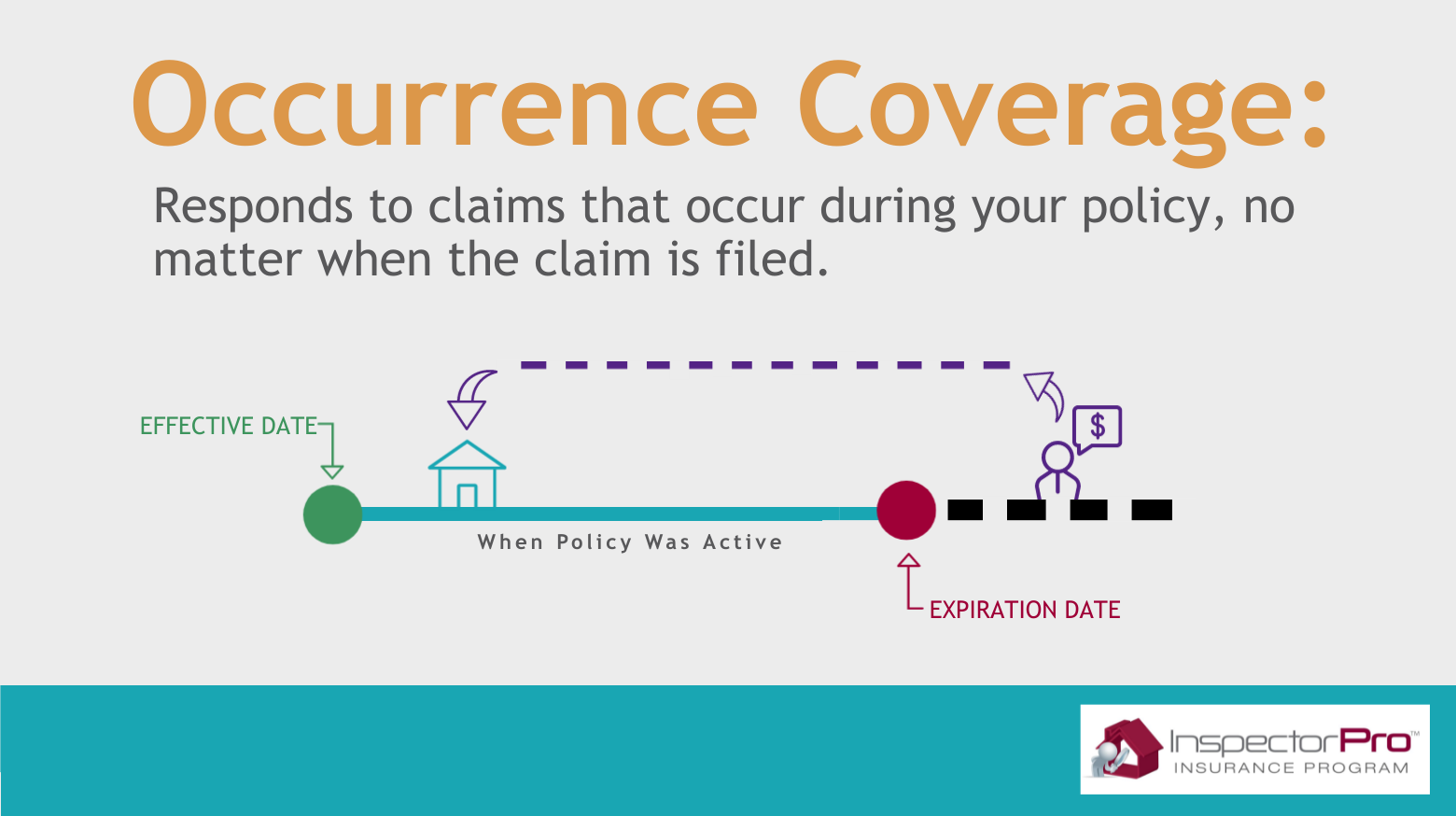

Occurrence policies provide protection from covered claims during your policy period, regardless of when you file the claim, making it unnecessary to purchase an extended reporting period (ERP) endorsement, or “tail” coverage, before your last policy lapses.

For example, an inspector performs an inspection during their occurrence policy period. Then, after his occurrence policy expires, the inspector receives a claim for the past inspection. His occurrence policy would still cover the claim.

At first, occurrence coverage seems like a great option. But there are some major caveats:

- Occurrence policies are rare.

When it comes to home inspection professional liability insurance, finding an occurrence policy is about as easy as finding a house with no visible defects. Very, very few insurance providers will write home inspectors errors and omissions (E&O) coverage on an occurrence basis.

- This coverage is very expensive.

For small business owners, every penny counts. And, while insurance is certainly an important and worthwhile investment, occurrence policies can be unduly expensive. Occurrence policy premiums can cost four times as much as a claims-made policy. The expense comes from the additional coverage you may (or may not) use after your policy expires.

Since occurrence policies are hard to find and pay for, most home inspectors have claims-made coverage.

Claims-Made Coverage

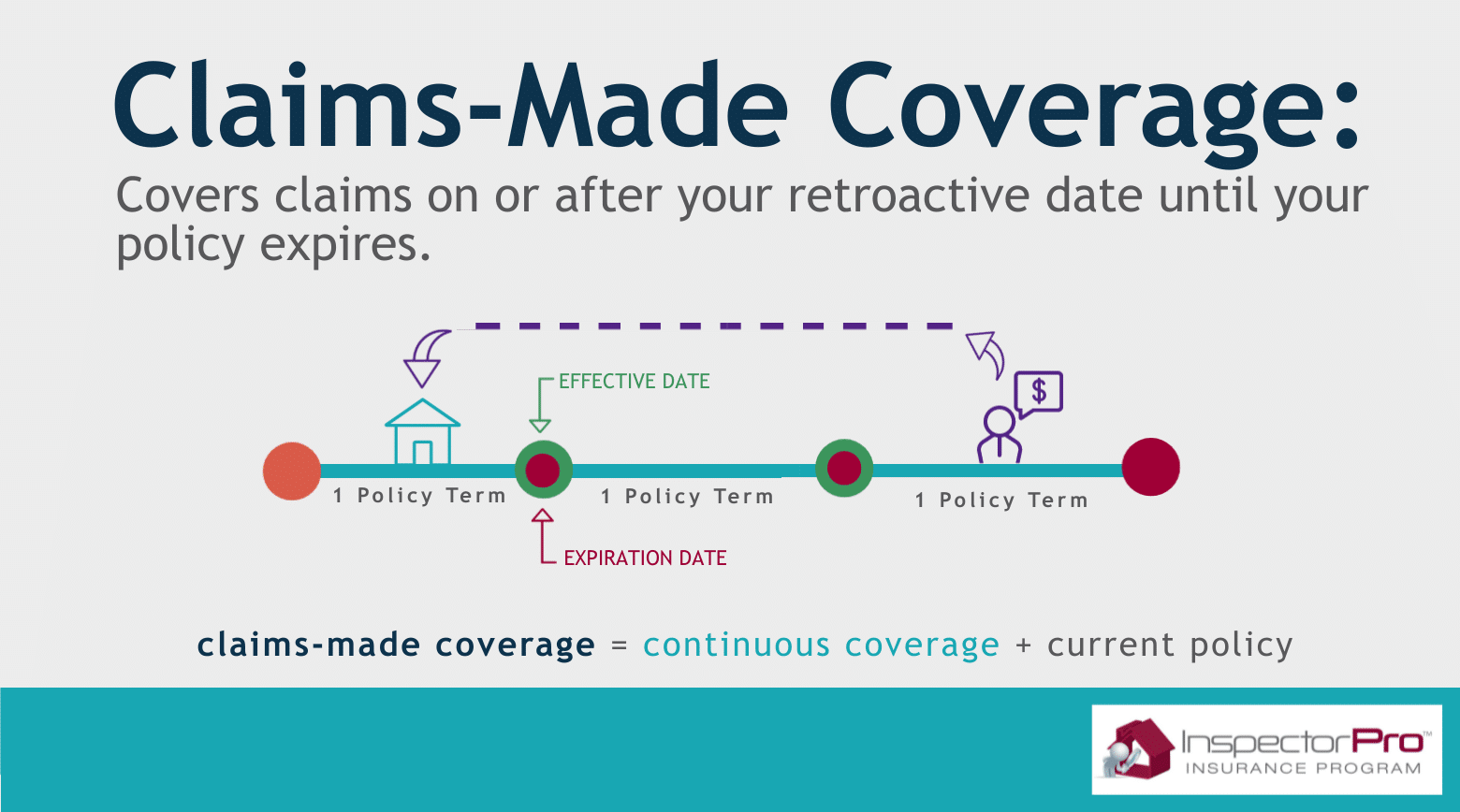

Claims-made inspection insurance relies on two dates to determine if a claim is covered: your retroactive date and claim filing date.

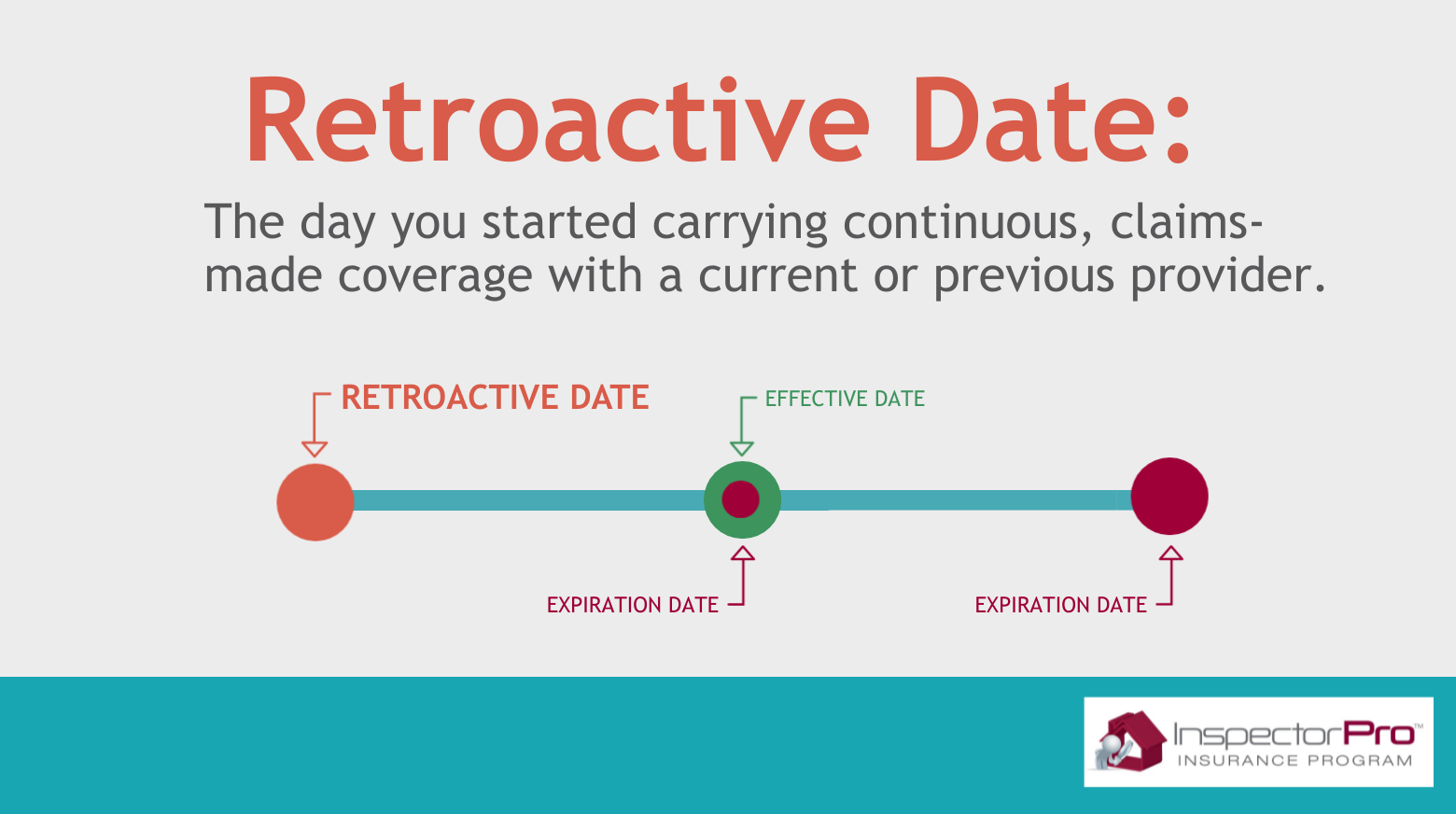

Retroactive Date

Your policy’s retroactive date is the day your uninterrupted insurance coverage began, which can be found on the declarations page of your policy. Indeed, you must have continuous coverage—no coverage lapses or gaps—to be protected from past claims.

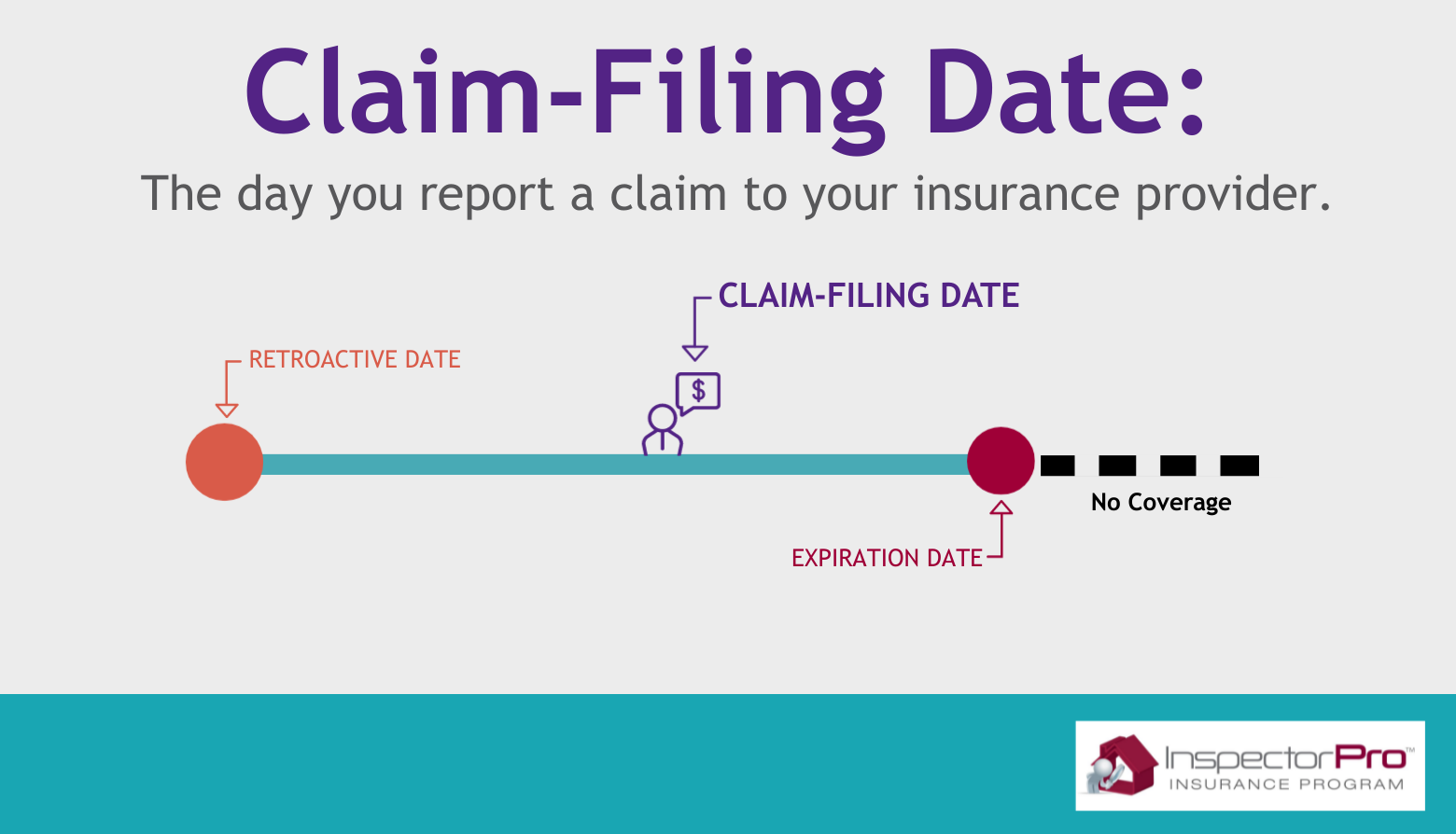

Claim-Filing Date

A claim-filing date is the day you report a claim to your insurance provider. While your claim-filing date can be the same day that you performed the inspection—think general liability claims—it usually isn’t. Ideally, the day you become aware of an issue—whether by phone or court summons—should be your claim-filing date. (To read more about the importance of reporting claims in a timely manner, read this article.)

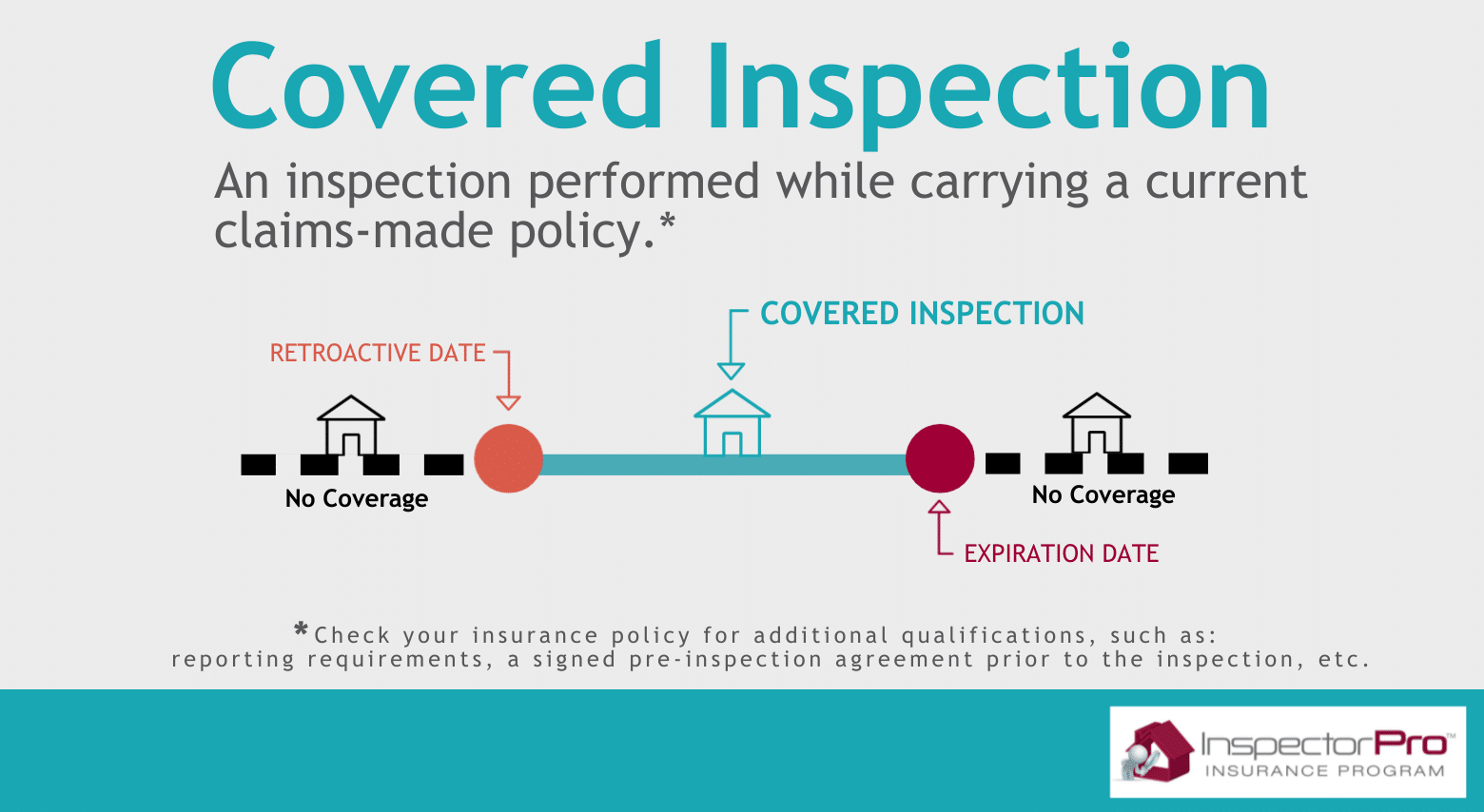

With your claims-made policy, you only have coverage for inspections you’ve performed while you have an active policy.

Claims-Made Timeline

Your claims-made policy covers claims from past inspections that occur on or after your retroactive date. To maintain coverage that extends back to your retroactive date—even for inspections you performed while insured with a different provider—you must have continuous coverage and a current policy.

Claims-Made Inspection Insurance Conclusion

To summarize, know what your policy does and does not cover. Be sure to ask questions when looking for an insurance provider, read your policy after you sign up, and continue to use your broker as a resource when unfamiliar situations come up.

Read about preserving your claims-made protection in our final retroactive coverage article.

Interested in obtaining a claims-made policy with us? Apply for a quote here.