Workers’ Comp for Home Inspectors: A guide to everything you need to know

Last Updated December 1, 2023

Not long ago, we were looking at a home inspector’s workers’ compensation policy with another insurance carrier. Unknown to that home inspector, their carrier wasn’t familiar with the inspection industry. Despite their lack of know-how, the carrier didn’t want to turn the home inspector away. Instead, the provider sorted the client into the closest group they already insured: window blind installation.

With a window blind installer’s workers’ comp policy, the business lacked coverage for many risks their home inspectors faced. For example, since window installers don’t mount roofs, they weren’t covered if a staff member fell off a roof. By signing with someone not in tune with their work, the firm’s needs were not met.

Seeing the need for coverage in the industry, we launched our home inspector workers’ compensation policy in June 2019.

We recognize workers’ compensation can be confusing. In this article, we explore common questions that arise when shopping for workers’ comp, including: What is workers’ compensation insurance? What does workers’ compensation cover? How does workers’ compensation work? And how much does workers’ comp cost? Hopefully, we can help you make an informed workers’ comp purchase with us or someone else.

What is workers’ compensation insurance?

Leaders have paid sick and injured workers after workplace mishaps for eons. Ancient Greek, Roman, Arab, and Chinese law all declared precise payments for injuries and disabilities. Their laws were the basis for the workers’ compensation insurance we have today, according to AmTrust Financial.

But workers’ comp is unlike errors and omissions (E&O) insurance, which covers allegations of neglect, failure to perform, and bad advice. It isn’t general liability (GL) insurance either, which covers inspection-related bodily injury and property damage claims for non-employees. Workers’ comp for home inspectors looks out for people who work for you. It provides your staff with access to medical and wage benefits in cases of workplace injury.

Accidents happen, and some of those accidents result in workplace injuries. When one of your employees gets sick or injured at work, they and your business suffer. But having occupational injury and illness costs covered through workers’ comp can soften the blow. Employees with workers’ comp benefits and empathetic employers may be more productive, more committed, and more personable, according to Texas Mutual. And, as an inspector-employer, carrying workers’ comp can give you peace of mind, help you abide by state mandates, and reduce your risk of financial setbacks. Everybody wins.

What does workers’ compensation cover?

Unlike other types of small business insurance, your state determines your workers’ comp benefits, terms, and exemptions. That means what workers’ comp covers varies from state to state. However, most home inspector workers’ compensation policies provide coverage for the following:

- Medical Bills: From doctors’ appointments to hospital visits, to medications and mobility aids, workers’ comp helps pay to treat employee illnesses and injuries. According to a 2018 report by the National Academy of Social Insurance (NASI), medical-bill-related claims are the most common type of workers’ compensation insurance claim.

- Lost Wages: Work-related injuries and illnesses can be so bad that employees cannot work. As a result, workers’ comp pays the recovering employee a portion of what they would be earning. How much does workers’ comp pay for lost wages? Usually, workers are paid two-thirds of their wages up to a state-mandated, weekly maximum. To learn more, read this article by Forbes.

- Rehabilitation: Workers’ comp may offer medical rehab benefits like physical therapy. They can also help pay for vocational rehab to help badly injured workers return to work in a new role.

- Death: If an employee dies from a work-related injury or illness, workers’ comp may help cover their funeral costs and their family’s lost income.

Here are some events a home inspector workers’ compensation policy might cover:

- While walking on a roof, an employee falls off her ladder and fractures her leg. She takes a trip to urgent care and then needs three months to recover with physical therapy.

- While driving to an inspection, an employee gets into a car wreck that hospitalizes him for a day.

- During a generator inspection, an inspector gets electrocuted by a live wire. He takes a trip to the ER and has an EKG.

How does workers’ compensation work?

For employees to receive workers’ comp benefits when they get sick or injured on the job, their employer needs to have coverage. As with other business insurance, employers are responsible for paying their insurance premiums.

When an employee suffers from a workplace injury or illness, they should report it to you, their employer. It’s then your job to file the claim with your workers’ comp insurance company. Based on your policy and the claim, your carrier will determine eligibility and benefits.

If one of your staff asks you to file a claim, you may wonder: How long does workers’ comp last? If they were injured today, how long can they receive benefits for that injury? As with all things workers’ comp, it depends on your state. Some have a specific number of weeks or years your employee can receive benefits. Other states say they can be on workers’ comp until they’re able to come back to work or a medical professional has said they’ve reached Maximum Medical Improvement (MMI).

Want to learn more about what you need to do when there’s a work-related injury? Download our Workers’ Compensation Claim Guide for free here. In it, we answer questions like:

- How and when should I get my employee medical help?

- What can I expect when I file a workers’ comp claim?

- How can I find doctors covered by my insurance?

- What happens when workers’ comp is approved?

- What happens if my employee’s claim isn’t covered?

When should I carry workers’ comp?

If you’re a small home inspection firm owner, you may be wary of taking on an extra expense for workers’ comp. Perhaps you only have one or two employees, so insurance doesn’t seem like a need. And what about part-time employees? Does it make sense to carry workers’ compensation insurance for them?

Even if you have just one part-time worker, experts suggest carrying workers’ comp. Even independent contractors and remote workers can receive benefits under many policies.

But even if experts’ opinions don’t sway you, your state requirements should. All states but Texas mandate that small business owners carry workers’ comp. States that mandate workers’ comp differ in when they require employers to have it and how much they need to carry. Below, find a quick chart with links of where to go for more info.

Workers’ comp by state

Keep in mind that North Dakota, Ohio, Washington, and Wyoming are monopolistic states. That means you can’t get your workers’ comp insurance through a commercial broker like InspectorPro. Rather, you have to be covered through your state-specific fund.

What happens if I don’t carry my state-mandated workers’ comp?

If you don’t carry workers’ comp and your state requires it, you may be subject to penalties. Penalties (mostly fines) vary in nature based on a few factors. For instance, how many workers you have, how long you’ve been non-compliant, and whether your non-compliance was willful affects penalties.

Some states have more severe sanctions. For example, non-compliance in states like California, Illinois, Massachusetts, Michigan, and Pennsylvania can lead to jail time.

Even if you’re in one of the non-regulated states, we still suggest having workers’ comp. Despite your best training and safety measures, accidents and injuries can (and do) happen. And although many firm owners create a family-like setting within their companies, a lack of workers’ comp coverage can lead even the best staff members to pursue punitive damages. Even if an accident or a lawsuit seems unlikely, it’s better to be prepared to take care of your employees and safeguard your assets.

Here are some examples of injuries and illnesses the inspectors we insure or have interviewed for articles have suffered:

- A broken arm from falling off a slippery roof

- Heatstroke while navigating an attic on a hot summer day

- Burns from touching an energized circuit

- Cutting your head on a protruding nail in a crawlspace

- Sickness from inhaling mold

We’re not trying to fearmonger, but we do want to set expectations of how often and sudden injuries can occur. Having workers’ comp can make responding to accidents and emergencies easier.

How much does workers’ comp cost?

A careful comparison of the cost of workers’ comp and the cost of a future lawsuit reveal that investing in workers’ comp is a great way to protect your business from financial burdens, too.

As with all insurance, your workers’ comp premium, or the amount of money you pay the insurance company each policy period, is unique to your business. Carriers use many factors to gauge your rate, including:

- Industry

- Region

- Payroll

- Claims History

We discuss each in more detail below.

Industry

By sorting your work into class codes, or industries, insurance companies can gauge rates based on perceived risk.

For example, say your firm has an administrative team and an inspection team. Because the office staff is exposed to less risk sitting at desks, they will likely cost less to insure than employees who are climbing on roofs.

Insurance underwriters determine class-specific rates based on claims data for all businesses with your same classification code. Generally, the lower the on-the-job risk, the lower the workers’ comp premiums.

Region

After looking at your industry, underwriters overlay the economic factors and requirements of your specific state. Because individual states regulate workers’ compensation insurance, your jurisdiction plays a huge role in determining what you pay.

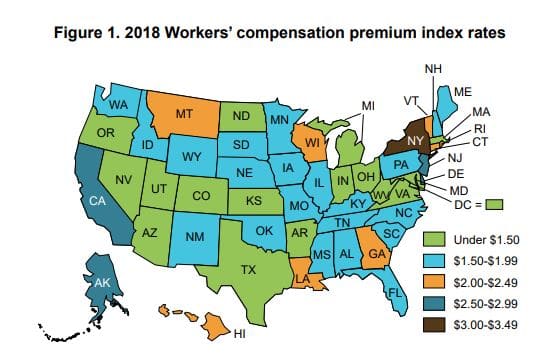

In 2018, the Oregon Department of Consumer Business and Services (DCBS) conducted a study that ranked all 50 states based on the average premium rates their employers pay. The study found New York, California, and New Jersey have the highest workers’ comp premiums. Meanwhile, North Dakota, Indiana, and Arkansas have the lowest.

(Courtesy of the Oregon Department of Consumer and Business Services)

Payroll

Employees’ payroll also impacts your workers’ comp rate. For each $100 of your payroll, your insurance company charges a rate based on the industry classification codes mentioned earlier. The more workers you have, and the more work they do, the more workers’ comp will cost. That’s because more work and more employees means more exposure to potential injuries or illnesses.

Claims History

If you’ve carried workers’ comp before, your workers’ comp claim record will factor into your rate. Based on how your loss run compares to other inspection companies of a similar size, your underwriter will adjust your experience modifier (MOD).

The higher your MOD, the more you pay. Conversely, the lower your MOD, the less you pay. Workers’ comp penalizes unsafe businesses with higher premiums and rewards safe businesses with lower ones.

As with your E&O and general liability insurance, the more frequent and costly your past claims, the higher your current premiums are likely to be. Though, in contrast to E&O and GL, you can receive premium credits or discounts for less frequent and lower-cost claims.

What features should I look for?

Remember the home inspector whose underwriter coded him as a blinds installer? While he carried workers’ compensation insurance, he didn’t have a policy that met his needs.

Having just any workers’ comp policy isn’t enough. You need sufficient coverage to protect your employees and your business from potential risks and financial disasters.

When shopping for workers’ comp coverage, we recommend seeking out the following features, all of which you’ll find in InspectorPro’s policies:

- Industry-Specific Coverage

- Reputation

- Security

Let’s talk about each of these bullet points in more depth.

Industry-Specific Coverage

Most carriers do little work with inspectors, because they perceive the inspection industry as too small or too risky. So when other providers run into inspectors needing coverage, they often label them incorrectly as professionals like general contractors, construction workers, or, in the case above, blind installers. Such flawed sorting can lead to severe exclusions—like workers not being covered while using ladders or mounting roofs. You might even get charged more money for the wrong coverage.

At InspectorPro, we work with one of the largest underwriters of workers’ comp in the nation to give you more options and more value. Furthermore, our carrier’s vast background allows them (and us) to plan for and adapt to your changing needs. So you can rest assured you have the right coverage today and tomorrow.

Reputation

A company’s reputation is how people perceive the organization and how it operates. Some questions you might ask to determine an insurance company’s reputation include:

- Are they knowledgeable about the insurance and inspection industries?

- Are they passionate about what they do?

- Do they respond promptly and listen to their customers?

- Do they share information to educate clients about risk management?

InspectorPro Insurance is a leader in the home inspection insurance space known for its first-rate service. Our workers’ comp policies are backed by the same team you’ve come to know and love through your E&O and general liability policies with the ASHI Advantage. But don’t take it from us. Check out our Google reviews here.

Security

Here’s a worst-case scenario: You get a workers’ comp policy. You’re paying your premiums. Then, one of your employees gets injured. You call your insurer to file the claim, but they tell you they can’t pay it. Your insurer has become insolvent.

Insolvency occurs when your insurer has less financial assets than liabilities, meaning they can’t pay benefits to their insureds. It can mean you’re stuck with the financial burden of paying for your employee’s workplace injury or illness even though you did what you were supposed to do by carrying a policy.

To prevent consumers from inadvertently buying insurance from a company with financial difficulties, credit rating agency AM Best scores insurance companies with letter grades based on how well they believe the company can pay for claims and other obligations. While it’s not a recommendation to purchase a policy on its own, it is a helpful consideration.

At InspectorPro, we’ve partnered with an insurance carrier backed by the strengths of a Fortune 500 company and an “A-” (Excellent) ranking from AM Best. Such a high score shows our carrier’s fiscal vigor and credit-worthiness.

Learn more about AM Best’s ratings here.

Protect your staff with workers’ comp for home inspectors

What is workers’ compensation and how does it work? Now you know!

Whether you have one or 50 employees, your staff needs protection. Workers’ compensation is a great way to defend your employees and your business against potential financial hardship from work-related injuries and illnesses. Do your part to abide by state law and safeguard your workers and business by having a workers’ comp insurance policy that meets the inspection industry’s unique needs. Click the banner below to get a quote for workers’ comp with InspectorPro today.

The ASHI Reporter published this article in their December 2023 issue.

Related Posts