How to improve your marketability with referring party indemnification

Last Updated June 21, 2024

During a recent home inspection, you missed the polybutylene pipes in the attic. When your clients, the home buyers, discovered your error, they were furious. They didn’t just sue you; they sued everyone involved in the home’s sale. That included the real estate agent that referred the job to you.

What is referring party indemnification?

In home inspection policies that include referring party indemnification, should there be a claim about inspection findings, the insurance company assumes liability for not just the home inspector but the referring party.

If your insurer offers third party indemnification, your insurance policy will define referring real estate agents, real estate brokers, mortgage lenders, relocation companies, and other relevant third party referral sources as limited additional insureds. As such, these referral sources can receive insurance coverage from claims arising from your inspection services.

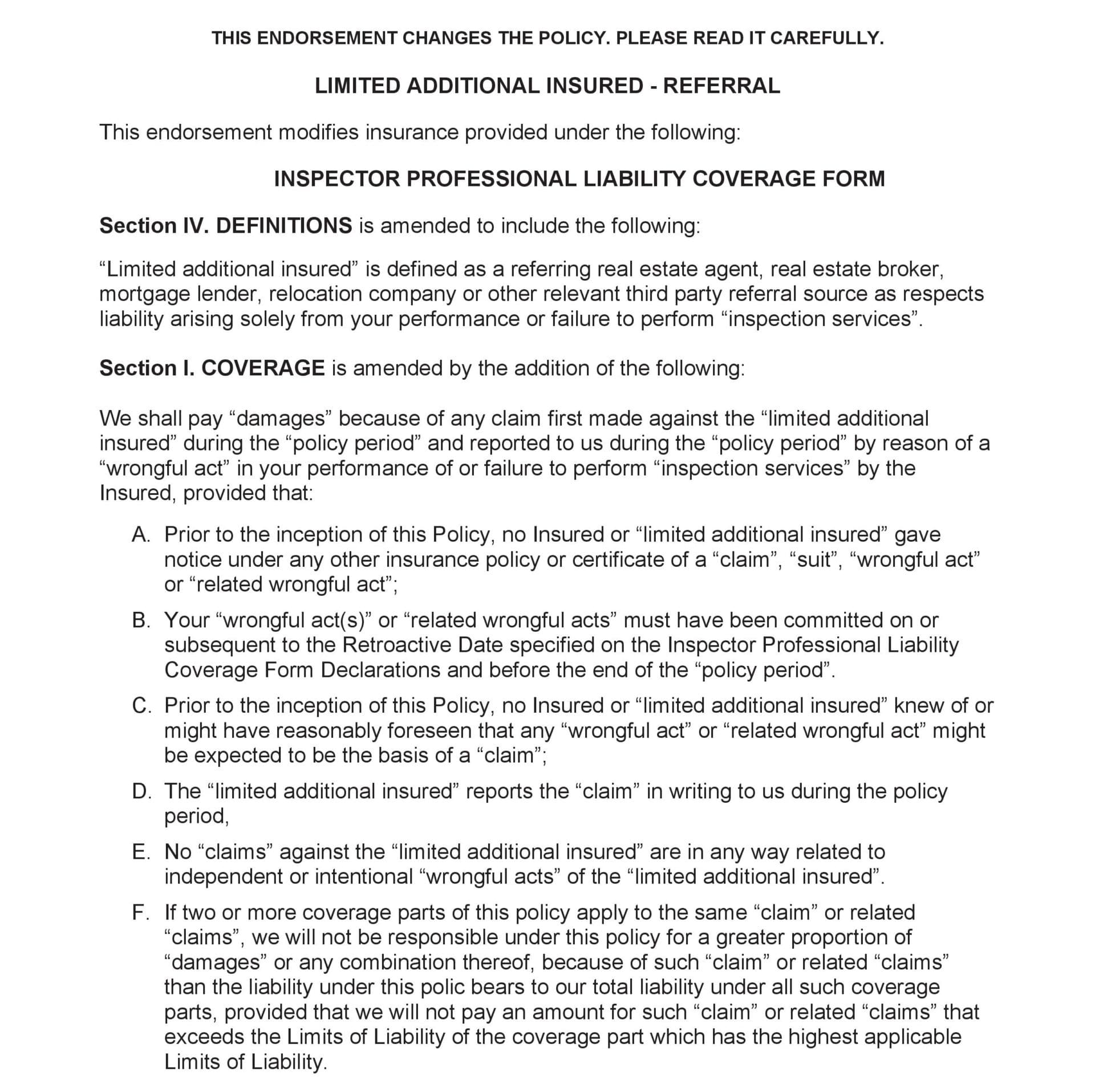

Here’s an example of what a limited additional insured referral endorsement might look like:

Common conditions to these endorsements include:

- You and the referring party didn’t give notice of the claim to another insurance carrier before your current policy began.

- The inspection related to the claim occurred on or after your retroactive date and before the end of your policy period.

- Before you started carrying insurance, you and your referring party couldn’t reasonably predict that your clients were going to file the claim.

- The referring party reports the claim in writing to your carrier during the policy period.

- The claim doesn’t involve any services the referring party performed independent of you, the home inspector.

- The claim is subject to your insurance limits.

In addition to insurance carriers, some other companies offer referring party indemnification to home inspectors. For example, InterNACHI members receive free negligent referral protection for real estate agents up to $10,000. And Residential Warranty Services (RWS) offers individual real estate brokers deductible reimbursements for up to $5,000. Just like you do with your insurance policy, we recommend reviewing any referring party indemnification plan you intend to use to make sure you understand the terms.

How can referral coverage improve my marketability?

As a home inspector, Paul Stratton, Owner of Stratton Inspection Services, LLC in Arizona, finds that realtors worry about potential claims. Many are concerned that, if the home inspector they refer to the client misses something, they’ll be liable. Stratton calms brokers’ nerves by explaining that his insurance policy protects them, too.

As a home inspector, Paul Stratton, Owner of Stratton Inspection Services, LLC in Arizona, finds that realtors worry about potential claims. Many are concerned that, if the home inspector they refer to the client misses something, they’ll be liable. Stratton calms brokers’ nerves by explaining that his insurance policy protects them, too.

“Realtors want to know that they’re covered and that their client is covered as well,” Stratton told us in an interview for our article “How to work with more realtors.” “[Referring party indemnification] gives them more peace of mind.”

In Stratton’s experience, having protection through the inspector’s insurance can make real estate agents less hesitant to recommend them to clients. Recognizing how he could use referring party indemnification as a marketing tool, Stratton designed a presentation for realtors about it. Furthermore, by educating real estate agents about the benefit, Stratton opened himself up to more realtor relationships.

“You can better educate [realtors] and, at the same time, market yourself a bit,” Stratton said. “If they know that you’re adding value to what they want and you’re not just tooting your own horn, I think they’re more apt to use you.”

Referring Party Indemnification and Marketing

There are many ways you can use referring party indemnification to market your business. We discuss the two most popular methods below.

Create a flyer.

Showcase that your business provides referring party indemnification with an informational flyer. Keep the flyer short and sweet by simply describing what referring party indemnification is and how it benefits your referral sources. Then, distribute these flyers to the real estate agents, real estate brokers, mortgage lenders, relocation companies, and other relevant third party referral sources in your area.

Give a presentation.

Like Stratton Inspection Services, LLC, you, too, can give presentations on referring party indemnification. Firstly, schedule times to stop by the real estate offices in your area to discuss home inspections. Toward the end of your presentation, you can discuss why agents should choose your home inspection business over your competition’s. Referring party indemnification can be one of the differentiators you highlight.

Give your referral sources peace of mind.

Give your referral sources peace of mind by letting them know your insurance policy comes with referring party indemnification. By carrying home inspection insurance, you protect not just you but those that work with you. And that extra coverage toward referral sources can be yet another tool to market your business.