Your Pre-Inspection Agreement: Your First Line of Defense

Last Updated November 22, 2023

In California court case Moreno v. Sanchez, the home buyers sued their home inspector for breach of contract, negligence and negligent misrepresentation. The buyers had discovered dust and asbestos, an inoperable drain, defective windows and wall cracking. They believed that the inspector should be responsible for the damage.

In California court case Moreno v. Sanchez, the home buyers sued their home inspector for breach of contract, negligence and negligent misrepresentation. The buyers had discovered dust and asbestos, an inoperable drain, defective windows and wall cracking. They believed that the inspector should be responsible for the damage.

The inspector’s primary defense: his inspection agreement, which included a one-year statute of limitations that required claimants to file any complaints within one year of the inspection. Based on just one line of the inspector’s contract, the court dismissed the charges.

“Generally, the reason you get a signed writing is because the contract the [client] signs is going to have a variety of terms in it that are beneficial to the home inspector to give them some light legal coverage,” said Mark Gergen, professor of tax law and policy at University of California, Berkeley.

While not required by the statute of frauds nor by all 50 states, Gergen explained, signed contracts can be advantageous to inspectors because they provide some protection of inspection terms, like the standards of practice and the scope of the inspection.

In Moreno v. Sanchez, even if the statute of limitations clause hadn’t held up in court, the agreement would have provided additional defense. According to court documents, the contract “specified the home inspection was limited to a visual inspection” and “excluded, whether or not concealed, soil conditions and asbestos.”

What is a pre-inspection agreement?

Your pre-inspection agreement is your first line of defense. It is your contract between you (the home inspector) and your client (the person[s] for whom you are performing a property inspection). The agreement’s purpose is to protect both you and your client by setting correct inspection expectations, including services you’ll perform and the payment they’ll make.

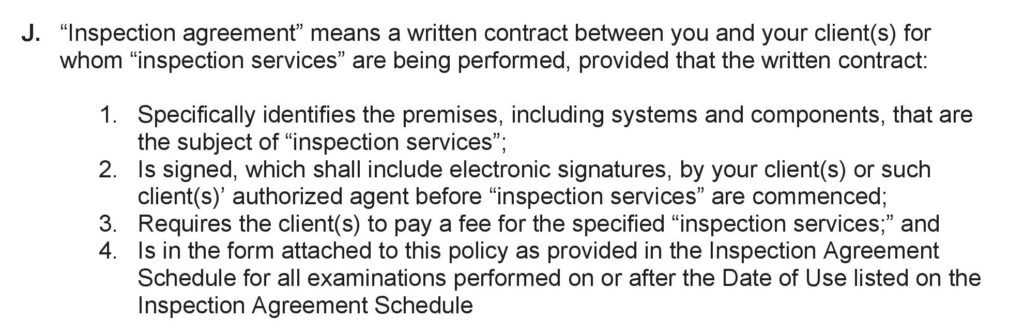

The Definitions section of most home inspection insurance policies outlines parameters for what basic elements inspectors’ contracts can or must include to qualify for coverage. The following is the definition of “inspection agreement” in the InspectorPro policy:

Identifies the premises.

Providing the address of the inspection property is your first step in identifying the inspection premises. By elaborating on which systems and components your inspection includes and excludes, you will set client expectations and limit your liability.

Is signed.

Inspectors must obtain signatures on their agreements prior to the inspection 100 percent of the time. This adequately protects them from potential claims. (In a future article, we will explore the legal reasons why contracts need signatures prior to inspections.) This section of the policy also specifies who can sign and how. Read this definition to answer questions like “Does my policy allow real estate agents to sign my pre-inspection agreements on my clients’ behalf?” and “Can I obtain digital contract signatures and still receive coverage?”

Requires the client(s) to pay a fee.

Note that many home inspection insurance policies do not provide coverage for free inspection services. However, most policies do not dictate how much a home inspector needs to charge so long as the client pays something.

Attached to this policy in a form.

Ever wonder why insurance providers ask for a copy of your pre-inspection agreement when you make your initial purchase or renew? It’s because insurance carriers make your contract an official policy document. As such, you must update the insurance company whenever you modify your agreement so that they can revise your policy.

Why are they important?

According to Clayton Somers of A Premier Home Inspection, LLC, in Virginia, there are three primary reasons why home inspectors need to obtain signed inspection contracts prior to every inspection:

- Contracts set expectations. By putting inspection parameters in writing, clients are more likely to understand the benefits and the limitations of their inspections.

- Some regulated states require inspectors to obtain signed contracts. Check the laws affecting your state and region to confirm.

- Most insurance carriers won’t cover claims arising from inspections lacking a signed pre-inspection agreement. This policy condition is due in part to how difficult it can be to limit liability without a contract. No contract means no parameters, and the client can demand almost anything. Furthermore, the cost of such a suit can make an inspector uninsurable, which can put them out of business.

Additionally, when confronting allegations, claims professionals often use signed pre-inspection agreements as the home inspector’s first line of defense. They do so by emphasizing the limitations of liability and inspection scope outlined therein. Frequently, claims adjusters can dismiss frivolous allegations against a home inspector with the help of the inspector’s pre-inspection contract—much like the California court dismissed Moreno v. Sanchez.

Make your pre-inspection agreement a priority.

According to Moreno v. Sanchez court documents, when the buyers arrived at the home inspection, they didn’t want to sign the pre-inspection agreement. In fact, they asked the inspector to remove the statute of limitations clause from the agreement. Imagine how different the case would have been if the inspector had dismissed the clause or, worse, the entire contract.

Inspecting without an agreement, or having clients sign your contract after you begin the inspection, isn’t worth the cost. Make your pre-inspection agreement a priority by getting it signed before every inspection.

Think your agreement could improve? Replace it with our state-specific contracts. We've built our agreements on the backs of over 15 years of claims handling. Click here to learn more.

The ASHI Reporter published this article in January 2020. See how this story appears in print below.